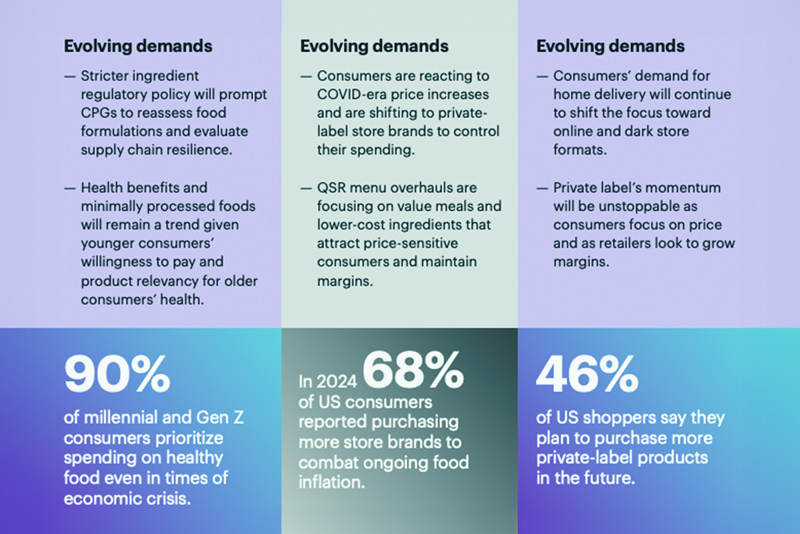

Millennials and Gen Z refuse to sacrifice healthy eating. According to Kearney's Food System Outlook 2025, 90% of younger consumers prioritize spending on nutritious food, underscoring a generational shift that places wellness above traditional markers of status like cars or housing.

Global management consulting firm Kearney released a new report, Food System Outlook 2025: Competing in a rewired food system, revealing that the global food system is breaking away from traditional operating models. The comprehensive analysis shows how three disruptive forces (evolving consumer demands, supply chain consolidation and rapid technology adoption) are reshaping operations across five connected ecosystems: broadacre, specialty crops, protein, ingredients and manufacturing and distribution, according to a news release.

“The global food system is facing fundamental structural and systemic change, and the old food system playbook doesn't work anymore. Input costs have never been higher, consumer expectations are more complex and technology is moving from optional to essential across every part of the food chain,” says Rob Dongoski, Kearney's global lead of the food and agriculture sector and co-author of the report. “Companies that understand how the five ecosystems connect and move fastest to automate, build regional agility and align with consumer needs will define what comes next.”

The research identifies three enablers for success: automation and data integration, regional agility in production and sourcing, and consumer-aligned innovation. Companies are discovering that protecting margins requires rethinking entire operating models rather than making incremental improvements.

“We're seeing a clear divide between companies that treat these changes as separate challenges versus those that are building integrated responses,” Dongoski says. “The winners are investing in automation partnerships, exploring CRISPR productivity gains and building climate-smart operations while simultaneously delivering on cost, transparency and sustainability.”

The outlook examines specific ecosystem dynamics. In specialty crops, 70% of growers report investing in automation technologies, while controlled environment agriculture shows strawberry yields 2.3 times higher than traditional field cultivation. The protein sector is adopting feed additives that reduce methane emissions up to 45% for beef cattle while addressing consumer demand that remains strong despite early plant-based alternative projections.

A few highlights from the report:

- Thirty-two percent of U.S. farmers use the internet to purchase agricultural products, and spend $500,000 a year on automation in response to the labor shortage.

- AI solutions can reduce food waste and restaurant operating costs; CRISPR gene editing technology is projected to reduce costs by 15% to 20%.

- New herbicide technologies can produce 76% savings in costs; pheromone-based pest control use has increased 56+% globally.

- Ninety percent of millennial and Gen Z consumers prioritize spending on healthy food even in times of economic crisis.

When it comes to millennial and Gen Z consumers, Dongoski explains that these priorities are shaping the food industry in profound ways.

“Consumer preferences, state-level bans, new weight-loss drugs and SNAP benefits are all converging to create a consumer profile that trends much more towards fresh foods — fresh meat, fresh produce, fresh veggies — and away from highly processed, sugary, salty foods and beverages,” he says. “I think it's a good time to be in the specialty crop space.”

According to The Packer's Fresh Trends 2025, millennials and Gen Z are leading the way in fresh produce consumption, with health being a key factor, as 81% of millennials and 79% of Gen Z cited “health reasons to get more produce in my diet.”

Among other reasons consumers say they are eating more produce, millennials rank highest in responding with “value/better bang for my buck,” (34%) and “because my doctor suggested I do so” (31%).

Specialty crops — fruits, vegetables and nuts — are well-positioned to meet this rising demand. Dongoski says that globally even markets that haven't traditionally embraced items like berries are developing an appetite for them, creating new opportunities for growers and exporters.

As far as how millennials and Gen Z define “healthy,” Rob emphasizes personalization.

“They'll define it differently depending on the category,” he explains. “For some, healthy means fresh. For others, it means fewer ingredients or less processing. A cleaner potato chip, for instance, might appeal more to a millennial or Gen Z consumer than to a boomer.”

This commitment comes with financial trade-offs. Younger consumers are willing to cut back on housing and transportation expenses to make room for healthful food in their budgets. Dongoski pointed out that fewer young adults are getting driver's licenses at 16, reflecting less emphasis on car ownership and more reliance on urban transit or ridesharing.

“But food is not one that Gen Zs and millennials will want to cut right out of the gate,” he says.

For retailers and producers, the message is clear: Healthy, fresh and clean-label products aren't just a trend; they're a non-negotiable priority for the next generation of shoppers.