Florida is on fire. A look at Circana total U.S. produce sales shows Florida and the Southeast markets have far outperformed the rest of the country over the course of the past three to four years.

Florida is also the fastest growing state in the country, according to the 2024 U.S. Census, and earlier this month, the Sunshine State was ranked No. 1 for attracting and developing a skilled workforce for the third consecutive year by Lightcast.

These and other favorable business conditions have continued to attract companies like the Oxnard, Calif.-based Mission Produce, which recently expanded its operations and distribution to Miami. Mission, which sources, produces and distributes fresh hass avocados and mangoes, says its Miami expansion is part of its focus on growth in “high-potential markets.”

“Florida, in particular, is ripe for growth. It's the fastest-growing state in the country, has a strong Hispanic demographic and already boasts avocado and mango sales that are above the national average,” says Brooke Becker, Mission Produce senior vice president of sales, pointing to Numerator Insights Shopper Metrics for the 12 months ending July 31. “That's a powerful consumer base paired with a dynamic retail landscape. By expanding in Miami, we're putting high-quality fruit closer to customers and helping them capture that upside.”

But Becker sees considerable room for growth in the region's avocado and mango sales.

“When you look at the numbers, the South is a powerhouse of opportunity…yet the region under-indexes on avocado sales by about five points,” she says, citing Numerator data. “That gap represents nearly $184 million left on the table. Closing even part of that gap — just one more avocado shopping trip per household — could add more than $100 million in sales. That's meaningful growth for retailers, wholesalers and foodservice alike.”

Florida by the Numbers

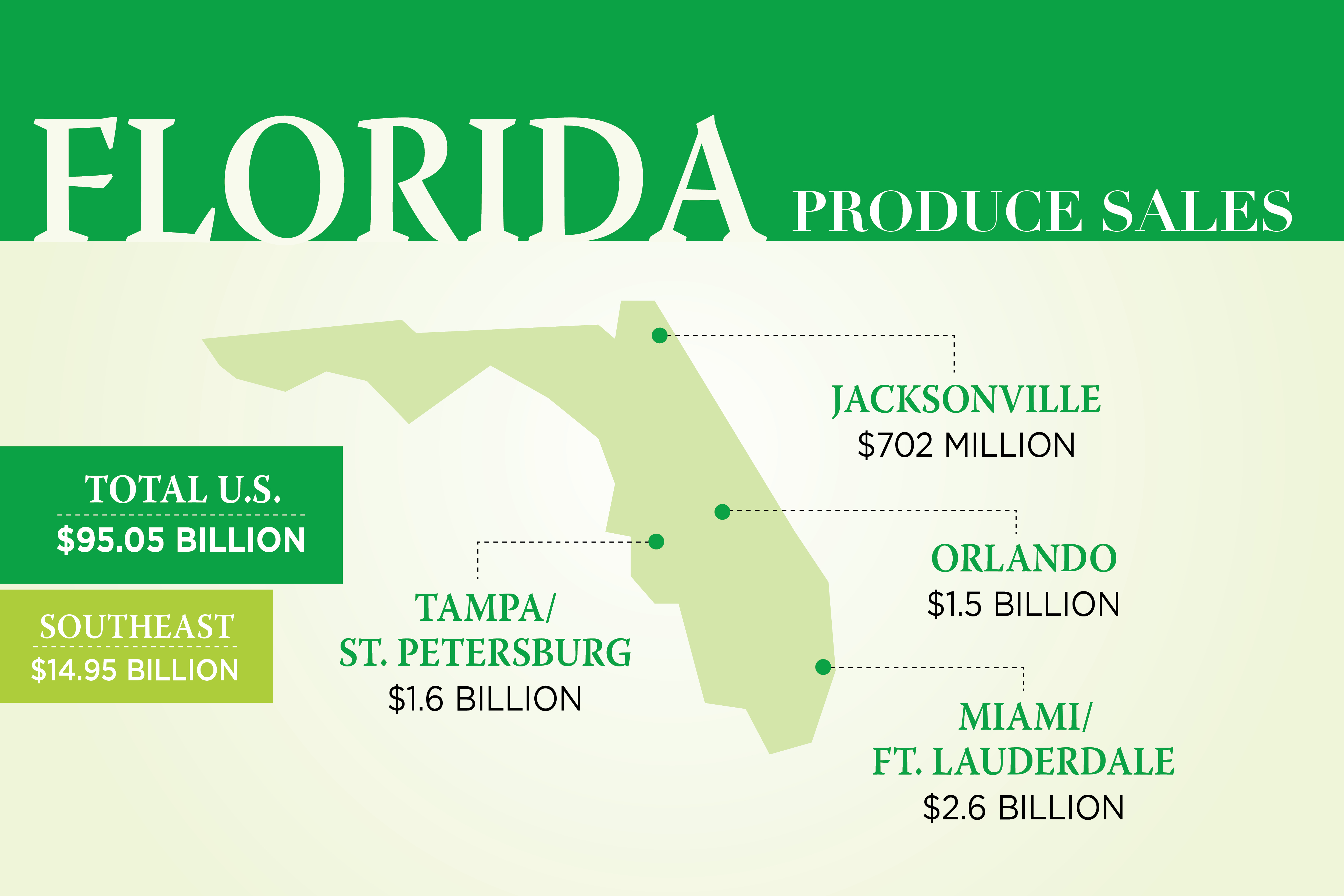

According to Circana data (Integrated Fresh, MULO+, Total U.S.), U.S. produce dollar sales percentage change versus a year ago has consistently risen for the Southeast region and Florida markets for the latest 52 weeks, and in Florida metro areas, including Jacksonville, Miami/Fort Lauderdale, Orlando and Tampa/St. Petersburg for the last four years.

Circana data shows that while total U.S. produce sales are up 18.4% versus four years ago, the Southeast's total produce sales are up 26.1% versus four years ago, Jacksonville is up 28.2%, Miami/Fort Lauderdale is up 27%, Orlando is up 30.6% and Tampa/St. Petersburg is up 25.9%.

Circana, Integrated Fresh, MULO+, Produce Sales Total U.S., Southeast region and Florida markets, latest 52 weeks:

- Total U.S.: $95.05 billion

- Southeast: $14.95 billion

- Jacksonville: $702 million

- Miami/Ft. Lauderdale: $2.6 billion

- Orlando: $1.5 billion

- Tampa/St. Petersburg: $1.6 billion

Thriving Retail, Strategic Position

Mission Produce has also cited the Southeast's more than 18,000 retail outlets as an additional boon to its expansion into Miami, as well the city's strategic location as an import hub.

“Mission Produce is already on the shelves of roughly 20% of retail stores across the Southeast, so our new Miami location positions us to better serve these existing customers and opens the door to new business opportunities,” says Becker citing Circana, Southeast region data for the 52 weeks ending Sept. 7. “We are now importing avocados and mangoes directly into Florida, enabling us to streamline logistics and reduce transit times. By operating in Miami, we're now able to leverage additional entry points into the U.S. to move product seamlessly across our network.”

Another benefit to Miami is that it serves as a strategic import hub for product sourced from Mexico, Peru, Colombia, Ecuador, Chile and other offshore origins, which Mission Produce says provides an additional value.

“Mission imports product to the U.S. from Mexico, Peru, Colombia, Ecuador, Chile and several others to provide a reliable, year-round supply of avocados and mangoes,” Becker says. “By operating in Miami, we're now able to leverage additional entry points into the U.S. to move product seamlessly across our network.”

The Hispanic Shopper

Florida represents one of the strongest growth markets for both avocados and mangoes. In the past 12 months, 76% of Florida shoppers purchased avocados and 46% purchased mangoes — well above the national average of 71% and 40%, respectively, says Mission Produce, pointing to Numerator Insights Shopper Metrics for the 12 months ending July 31.

What's more, the state's strong Hispanic demographic is important to the increased consumption of avocados and mangoes.

“Hispanic shoppers are central to the continued growth of the avocado and mango categories,” Becker says. “Nearly 90% of Hispanic households buy avocados and 60% buy mangos — and [according to Numerator, Shopper Metrics] they spend significantly more on both than the average shopper. These buyers greatly value ripeness and quality, and our Miami location enables us to deliver both at an even higher standard.”