Consumers are changing how they shop as grocery prices continue to climb. According to the Bureau of Labor Statistics, food-at-home prices rose 2.7% in 2025 compared to last year, with beef up nearly 14%, pork up about 1% and fresh produce increasing nearly 3% in late summer.

Amid that pressure, new data from Algolia's consumer survey shows 73% of U.S. shoppers are stressed about grocery bills this year, and it's influencing what lands in their carts. Nearly 40% have tried private-label products for the first time, seeking lower prices and better value.

“We're seeing a huge lift in store brand customers,” says Nate Barad, vice president of product marketing for Algolia. “Customers may have been hesitant before, but both the quality of the store brands and the deals have come up. It's become a win-win situation.”

Algolia's survey of 1,000 U.S. adults, both in-store and online shoppers, found that 60% participate in grocery loyalty programs, and 70% enjoy using grocery app games or ‘adventures' that offer discounts or new product trials. Nearly half (46%) said they want personalized deal recommendations based on their carts or past purchases.

Barad says these findings align with what Algolia sees from retailers using its AI-powered search and personalization tools.

How Fresh Fits Into the New Grocery Equation

While some analysts suggest shoppers are trading fresh for frozen, Barad says Algolia's data shows something different: Consumers are rethinking how they plan meals and use ingredients, not necessarily abandoning fresh food.

“We haven't seen a spike in frozen versus fresh,” he says. “What we're seeing is how people come about it. They're looking to use the same ingredients multiple times — like making chicken Parmesan pasta one day and a chicken Caesar salad the next. It's about meal planning and stretching ingredients.”

This shift toward intentional meal planning means fresh produce remains a key component of shoppers' baskets, but AI and search tools are changing how consumers discover what's available and affordable.

“In produce, inventory is now part of the search,” Barad says. “Retailers are using product freshness, shelf life and inventory data to influence what shows up first when consumers search for items like tomatoes or romaine. The AI can prioritize produce that needs to move now, which helps reduce waste and improve margins while still meeting consumer demand.”

The ability to surface nearby, in-stock and discounted produce options also helps grocers manage tight margins while keeping “fresh” accessible to price-conscious customers, Barad says.

Tech-Driven Grocery Shopping

According to the Algolia survey, shoppers view AI as a means to assist them in their grocery hauls and inspire them to create healthy meals. Specifically, consumers are eager to leverage AI agents for the following use cases:

- Real-time alerts about restocked items (58%).

- Suggest foods/meals based on dietary needs (56%).

- Organizing meal prep (51%).

Algolia's AI-driven “virtual shelving” feature, which builds a personalized shelf view from a shopper's list, has been especially popular, Barad says. Shoppers can upload a handwritten or voice-generated grocery list, and the AI populates comparable items by price, availability and brand.

“You can see all the romaine, all the pasta, all the chicken and all the cheeses,” Barad says. “From there, you decide if you want the organic chicken or the store-brand version. The AI helps you do more with less, finding the best cost on the products you actually want.”

He notes that while many consumers are cautious about AI (with 50% of survey respondents saying they don't fully trust AI agents to shop for them), most see its potential for convenience and savings. Nearly 60% believe AI will make grocery shopping easier, and 56% are interested in AI tools that suggest foods or meals based on dietary needs.

Fresh Meat, Dairy and Repeat Buys

Although the survey didn't break down results by protein or dairy category, Barad says Algolia's retail data shows repeatable staples, such as milk, ground beef, lettuce and cheese, are key drivers of online cart growth.

According to the Algolia survey, nearly half of consumers (46%) want grocery retailers to offer deal recommendations tailored to their current cart or past purchases. This number rises to 51% for millennials and 52% for Gen X.

“When those essentials are automated, when shoppers don't have to manually add things like hamburger or milk each week, we see up to a 50% lift in average order value,” Barad says.

He adds that for many retailers, securing those repeat fresh-item purchases is the key to building long-term loyalty.

Consumers' growing comfort with AI-assisted shopping, combined with their stress over grocery bills, is accelerating a new kind of grocery economy: one where affordability, personalization and freshness converge.

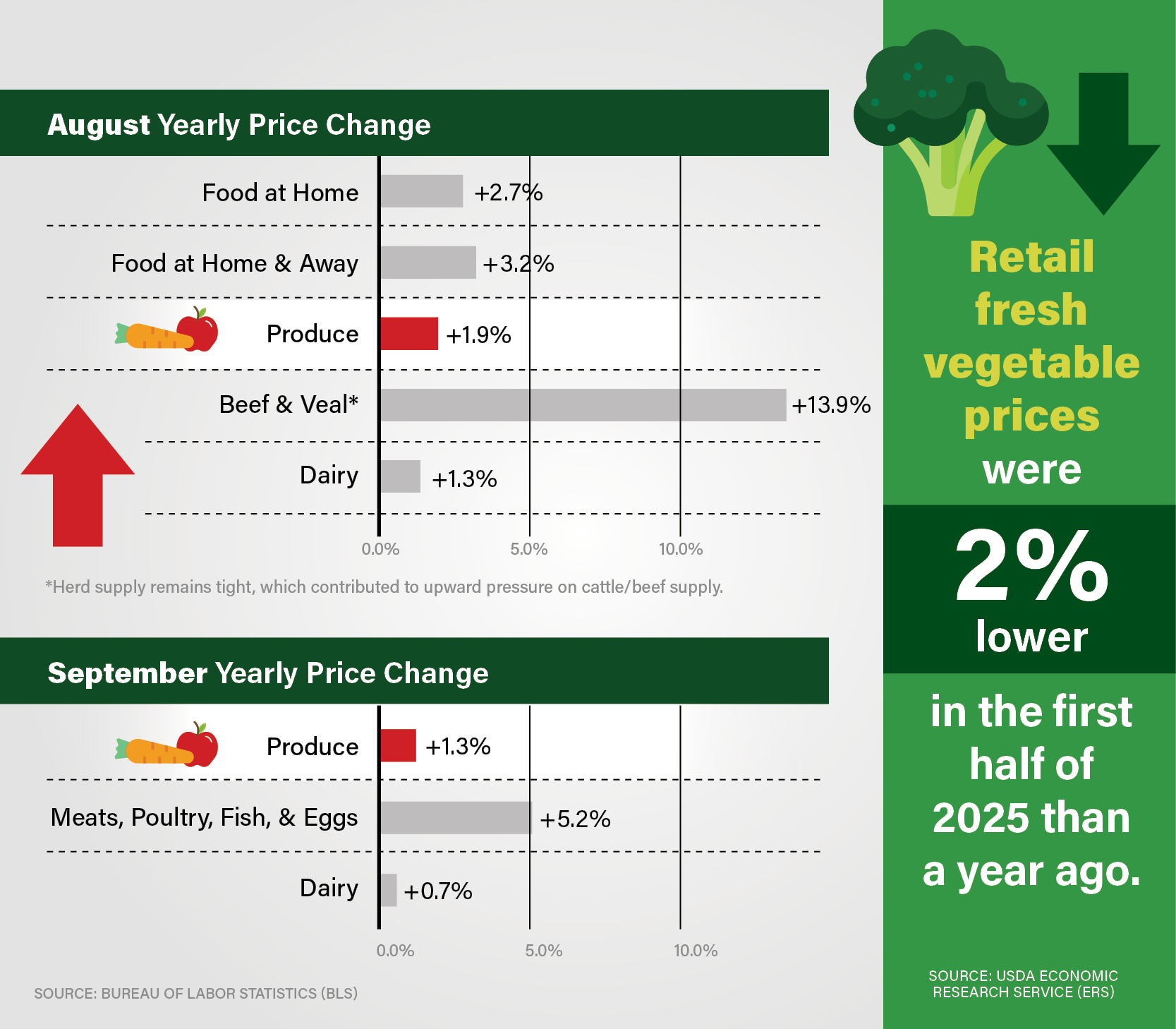

Grocery / Fresh Price Trend Data, 2025

Overall groceries (food at home)

- The Bureau of Labor Statistics (BLS) reports the food at home index (grocery store purchases) rose 2.7% over the 12 months ending August 2025.

- More broadly, food (all food including home + away) increased ~3.2% year over year as of the same period.

Produce (fruits & vegetables / fresh produce)

- The BLS index for fruits and vegetables rose 1.3% year over year in September 2025.

- Earlier, for the 12 months ending August 2025, the fruits and vegetables index rose 1.9%.

- On the retail side, the USDA Economic Research Service (ERS) reported that in the first six months of 2025, retail prices for fresh vegetables fell about 2% compared to a year earlier.

Meat (beef, overall meats and poultry)

- For the broader category “meats, poultry, fish, and eggs,” the BLS reports a +5.2% year-over-year increase in September 2025.

- Beef and veal retail prices rose 2.7% from July 2025 to August 2025, and were 13.9% higher in August 2025 than in August 2024.

- Also, herd supply remains tight, which contributed to upward pressure on cattle/beef supply.

Dairy

- The BLS reports dairy and related products' prices at grocery stores were up 0.7% year over year in September 2025.

- In August 2025, the dairy and related products index rose about 1.3% over the prior 12-month period.