As consumers continue to chase value in a still-inflationary economy, Dollar General is carving out a stronger foothold in the grocery landscape, according to a new Placer.ai report.

Elizabeth Lafontaine, director of research for Placer.ai says the shift toward Dollar General as a grocery destination reflects both consumer priorities and the chain's own investment in food.

“We've really seen over the past few years this shift of Dollar General gaining steam in the grocery category,” she says. “They've made a true investment in grocery and want to be seen as another option for consumers in the market. At the same time, consumers are laser-focused on value; that's the No. 1 lens they're using to make purchasing decisions.”

According to the report, fresh produce rollouts, expanded frozen assortments and a focus on “everyday essentials” have helped shift its positioning from an occasional convenience stop to a more frequent shopping destination.

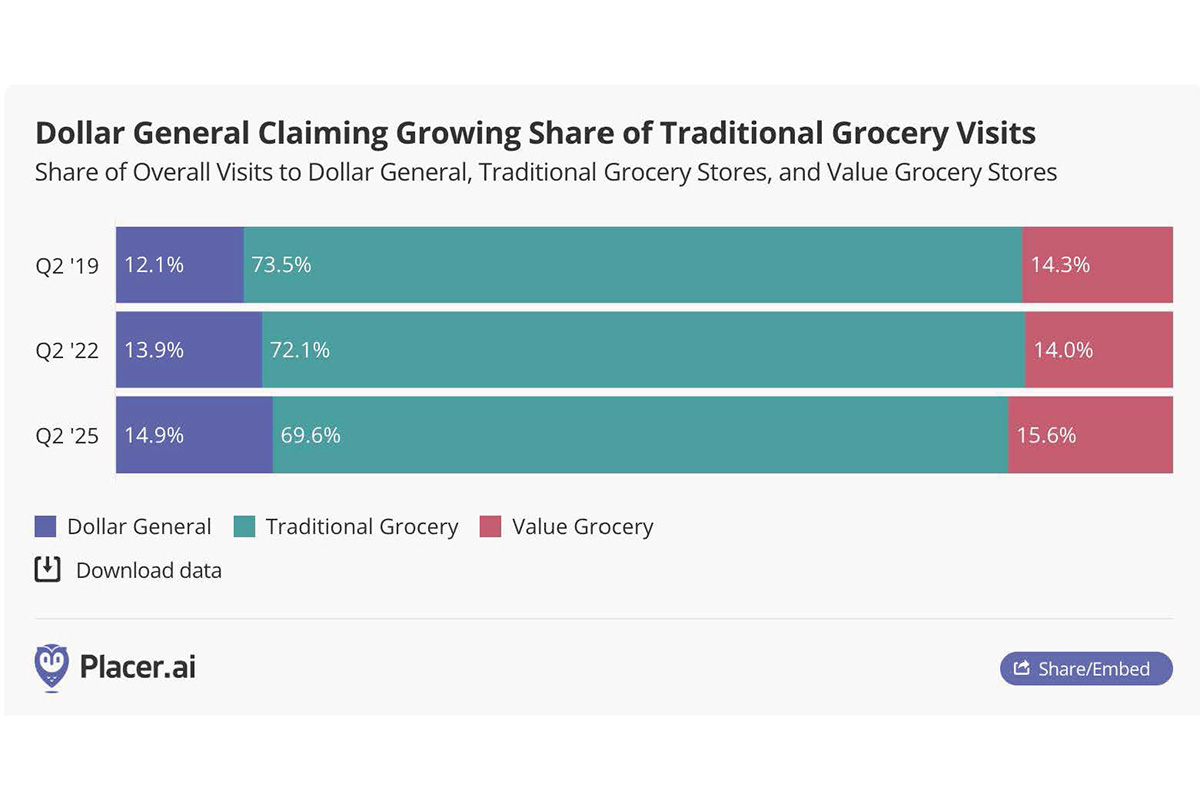

Foot traffic trends align with this shift. From Q2 2019 to Q2 2025, Dollar General's share of grocery visits — across both traditional and value chains — rose consistently, while traditional chains like Kroger and Albertsons lost nearly four percentage points, the report shows. Value grocers, meanwhile, (i.e. Aldi) remained stable through 2022 before gaining ground themselves, suggesting that Dollar General has primarily pulled shoppers away from traditional supermarkets even as other budget-oriented grocers strengthened.

“As Dollar General continues expanding its footprint and grocery offerings, its impact on how — and where — Americans shop for food is poised to keep growing. By capturing short-visit traffic and offering a broader grocery selection, the chain is reshaping the competitive landscape and prompting both traditional and value grocers to adapt,” the report says.

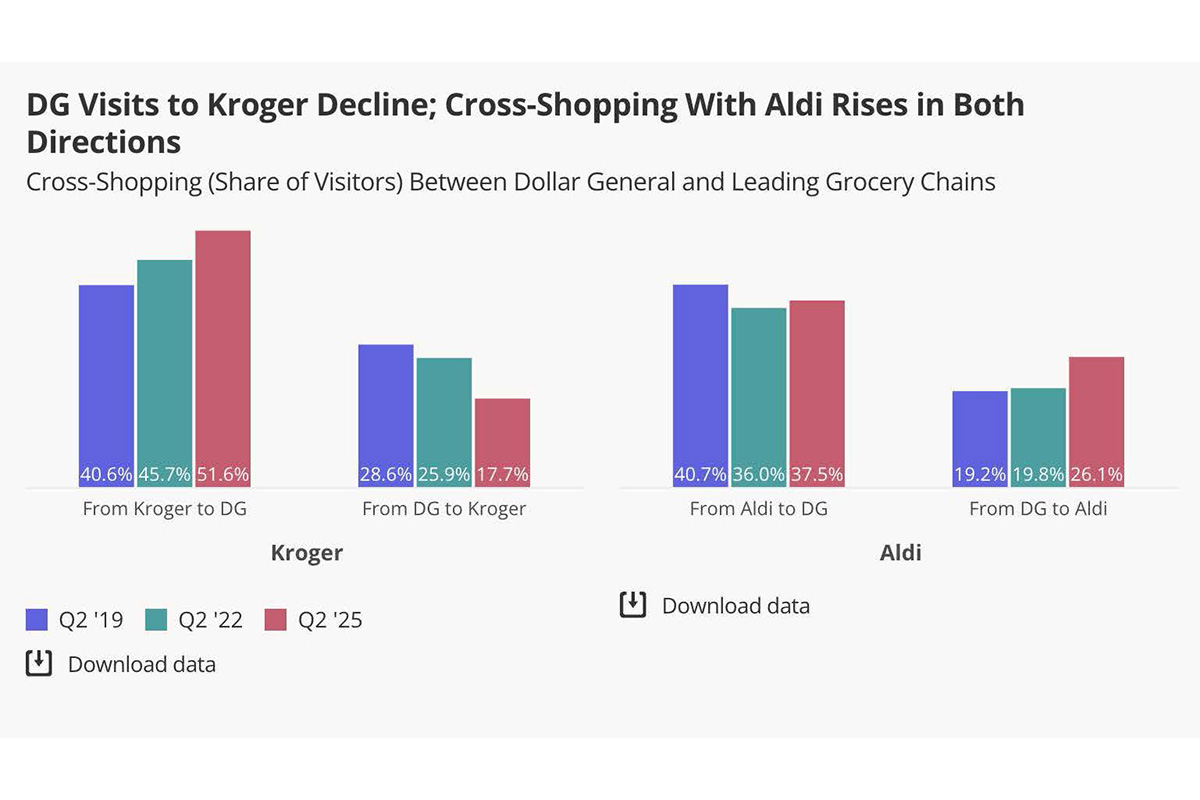

That alignment is paying off. Placer.ai's report shows that visitors to traditional grocers such as Kroger are increasingly cross-shopping with Dollar General, and that cross-visitation with Aldi is also on the rise.

“Consumers now view Dollar General as another option in their grocery Rolodex,” Lafontaine says.

While value-driven consumers remain Dollar General's core base, the retailer is also attracting new visitors outside its traditional demographic.

“We're seeing interest from customers who might not have typically been your value-based shopper before,” she says. “All consumers now are looking for as much value as possible.”

Much of Dollar General's success continues to come from rural markets, where the chain remains dominant. But the data suggests its reach is broadening, fueled by convenience, low prices and increasingly, expanded food offerings — including fresh produce and perishables.

Fresh Offerings Add Competitive Pressure

As Dollar General and other dollar chains remodel and expand their grocery selections, traditional supermarkets are facing more competition from multiple directions.

“The grocery category has become more saturated,” Lafontaine says. “We're seeing competition not just from traditional grocers or value-based chains, but also from superstores and dollar stores.”

She adds that while this competition is intense, consumers today are also more likely to shop multiple stores — curating their own mix of retailers for the best assortment and deals. That means traditional grocers can still hold their ground by offering specialized products, local produce or a differentiated experience.

Closures and Growth: The Dollar General Balancing Act

Earlier this year, Dollar General announced plans to close about 100 stores as part of an optimization effort, while simultaneously preparing for hundreds of new openings in 2026. According to Placer.ai data, that strategy appears to be working.

“Dollar General continues to grow its visits throughout 2025,” Elizabeth says. “Visits per location are becoming more productive over time. That really signals that the changes they've made to their store fleet have benefited them; they're engaging customers more effectively and attracting new ones.”

Even as Dollar General fine-tunes its footprint, it remains firmly in growth mode. Its continued investment in store upgrades, expanded food options and value messaging suggests dollar stores will remain an increasingly powerful competitor in the grocery, and fresh produce, space.