Shelf intelligence has become a strategic imperative with retailers moving decisively to invest in technologies that drive inventory accuracy, profitability and customer satisfaction, according to new research released by smart data capture company Scandit and IHL Group, a global research and advisory company focused on retail,

IHL Group says its research spanned more than 400 retailers across grocery, mass merchants, warehouses, drug stores and convenience store segments in the U.S. as well as Europe, the Middle East and Africa.

“Consumers often choose grocery stores based on fresh produce quality and leave when items aren’t available,” says Christian Floerkemeier, chief technology officer and co-founder of Scandit. “IHL’s research shows the retailers winning in fresh are those that are investing heavily in inventory visibility to reduce the chances of out of stocks occurring and increase customer loyalty.

“In addition, as grocery stores often have tens of thousands of SKUs, deploying a hybrid data capture approach enables retailers to monitor frequently via fixed camera or autonomous robots without the need for store associates to manually walk the aisles every day,” Floerkemeier adds. “With produce turning over faster than any other category, grocers need real-time visibility, not just weekly reports.”

Inventory issues including out-of-stocks, overstocks and misplaced items remain a critical challenge for retailers, the company says, equating to $1.73 trillion in lost sales annually, hitting retailer profitability in tandem. Consequently, inventory visibility ranks second as a technology investment priority behind personalization of the customer experience, according to the research. However, retailers with profit growth of 10%-plus are investing 208% more in inventory visibility solutions than profit laggards, the company says.

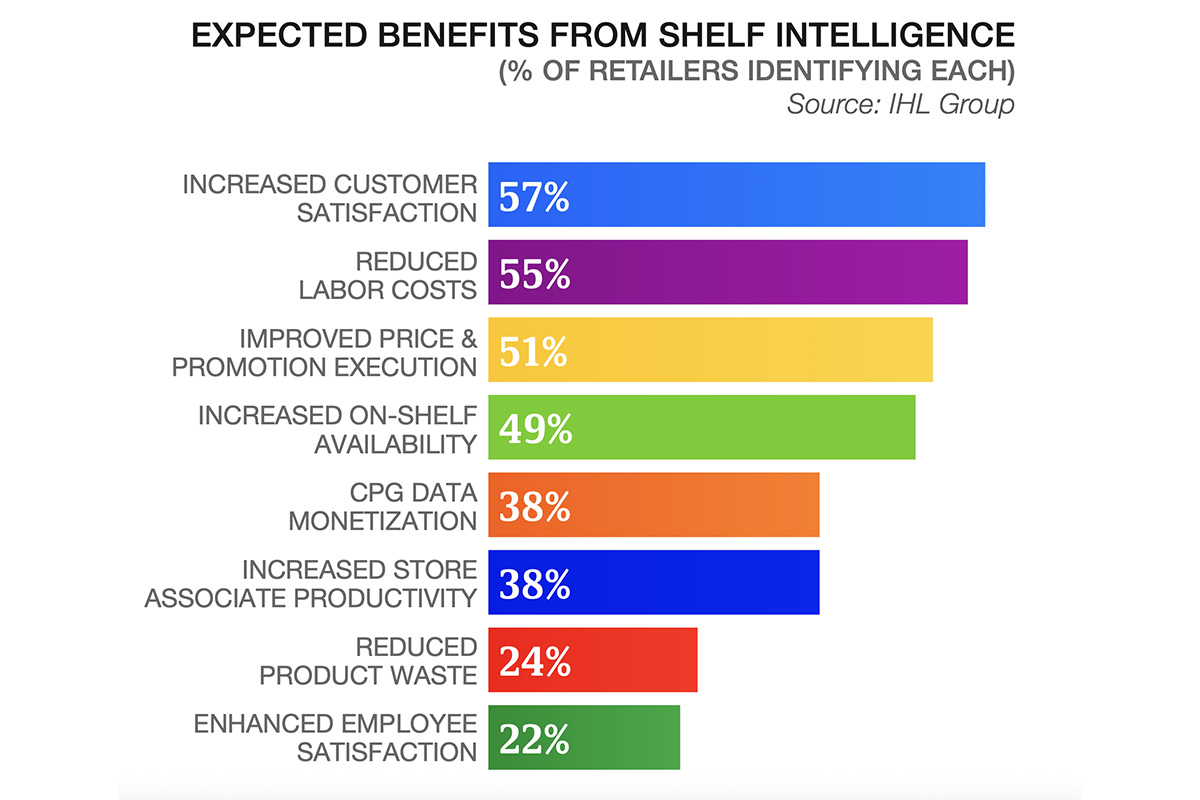

As the appetite for shelf intelligence deployment rises, retailers expect multiple benefits, including increased customer satisfaction (57%), reduced labor costs (55%), on-shelf availability lifts (49%) and higher store associate productivity (38%), according to the company.

The research highlights the maturity shift from early shelf intelligence deployments, which struggled with integration challenges, high costs and immature artificial intelligence models. AI spending by retailers is projected to grow by 29% from 2025 to 2026, the company says.

More retailers are now identifying as early adopters, with retail’s profit winners 94% more likely to invest in shelf intelligence solutions than their struggling peers, the research shows. Early adopters are recognizing a willingness to embrace operational transformation rather than settle for incremental improvements.

“While digital transformation has dominated the retail industry for the last decade, inventory accuracy and shelf availability continue to erode profitability,” says Greg Buzek, president and chief AI officer for IHL Group. “Our new research demonstrates that shelf intelligence technology has matured to a competitive necessity, and retailers who have embraced this shift are breaking away from the pack.”

When deploying shelf intelligence, retailers who have adopted a hybrid data capture strategy — using multiple methods, such as autonomous robots, fixed cameras and mobile devices — are 64% more likely to be early adopters, research shows. These same retailers are also 136% more likely to maintain profitability leadership. Over the course of the next 12 months, 36% plan to adopt a hybrid data capture strategy, demonstrating allocated budgets and implementation time lines — the single highest among planned shelf technologies. A further 21% are planning within the next 24 months, highlighting a market with momentum.

“Grocers and other retailers are no longer asking whether shelf intelligence works; they’re asking how fast they can scale it,” Floerkemeier says. “The data confirms what we are seeing in real-world engagements across North America and Europe where deployments are increasing, on-shelf availability rises of 5% are being realized and bottom lines are being positively impacted, underlining the overall strategic imperative.”