The Packer's Sustainability Insights 2025 survey paints a nuanced picture of grocery retailers' commitment to sustainability — showing solid engagement and placing high value on sustainability with a focus on meeting consumer needs and environmental consciousness.

Retailers reported sustainability as a high priority within their strategy and financial decisions, with 98% of respondents saying sustainability is either important, very important or extremely important.

When asked to choose the top three reasons they implement sustainable practices, retailers most often pointed to reducing food waste (54%), meeting customer priorities (43%), being “the responsible thing to do” (42%) and improving human health (28%). Legislative requirements rank far lower than in previous years, down from 19% in 2024 to 7% in 2025, possibly suggesting sustainability is increasingly driven by business and consumer considerations.

Despite these motivations, only one-quarter of retailers have set public goals for reducing greenhouse gas emissions, and of the 75% of respondents indicating they have no plans, only 15% said they plan to create them in the future. Similarly, the vast majority of retailers are not engaged with carbon credits (8% of respondents said they have purchased carbon credits), nor do they expect to in the future (82%).

Nearly two-thirds (60%) of retailers surveyed indicate the cost associated with the change as a challenge, up from 47% in 2024. Sustainability can mean many different things to different people, from environment to food quality to logistics to economics and beyond.

Defining sustainability varies between retailers and consumers, but there are some parallels. Environmental impact ranked highest among retailers (29%) and consumers (23%). Both retailers (12%, third) and consumers (14%, second) ranked freshness and shelf life high among the 12 categories in the survey. Waste reduction/packaging (13%) also ranked high for retailers.

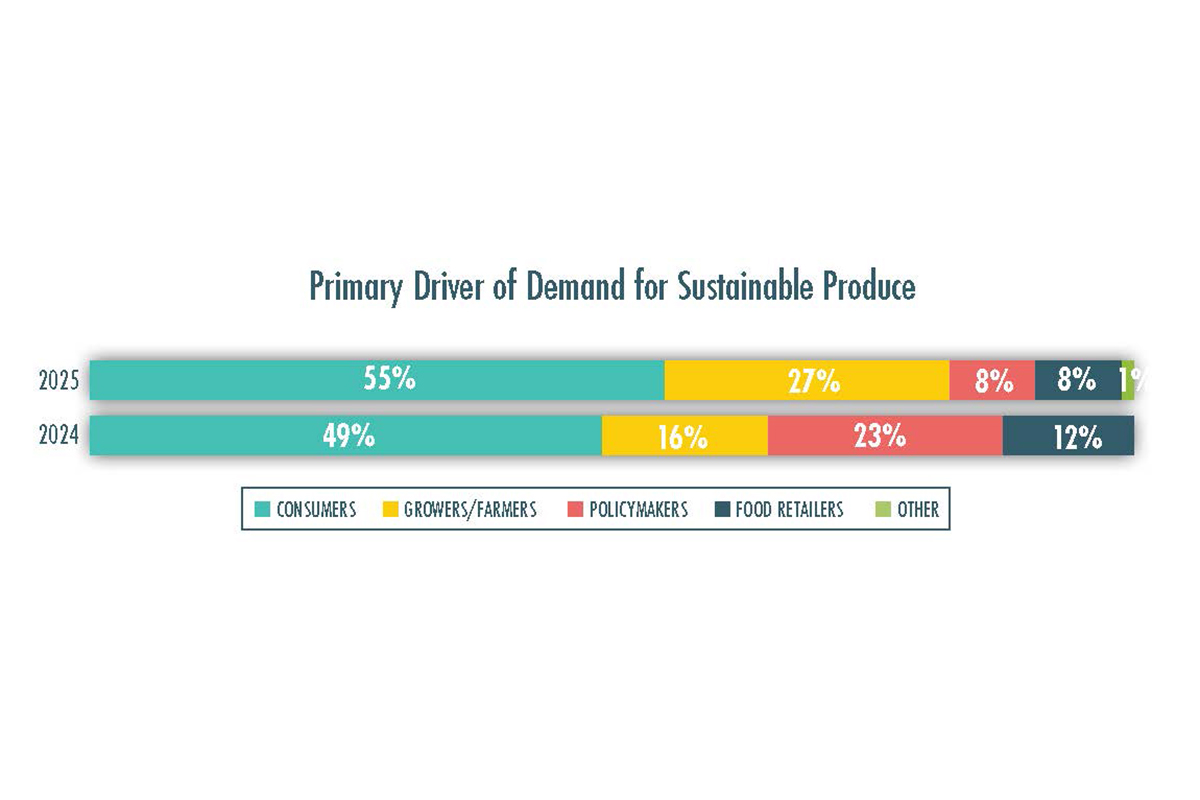

Retailers are seeing consumer interest in sustainability with nearly three-fourths of retailers (70%) reporting having seen an increased demand for sustainably grown or responsibly sourced produce in the last one to two years.

The top challenges retailers said they face in adopting new sustainable practices include costs to implement (60%), labor and talent (40%), time (35%), data/impact measurement (33%) and the hassle to implement (29%).

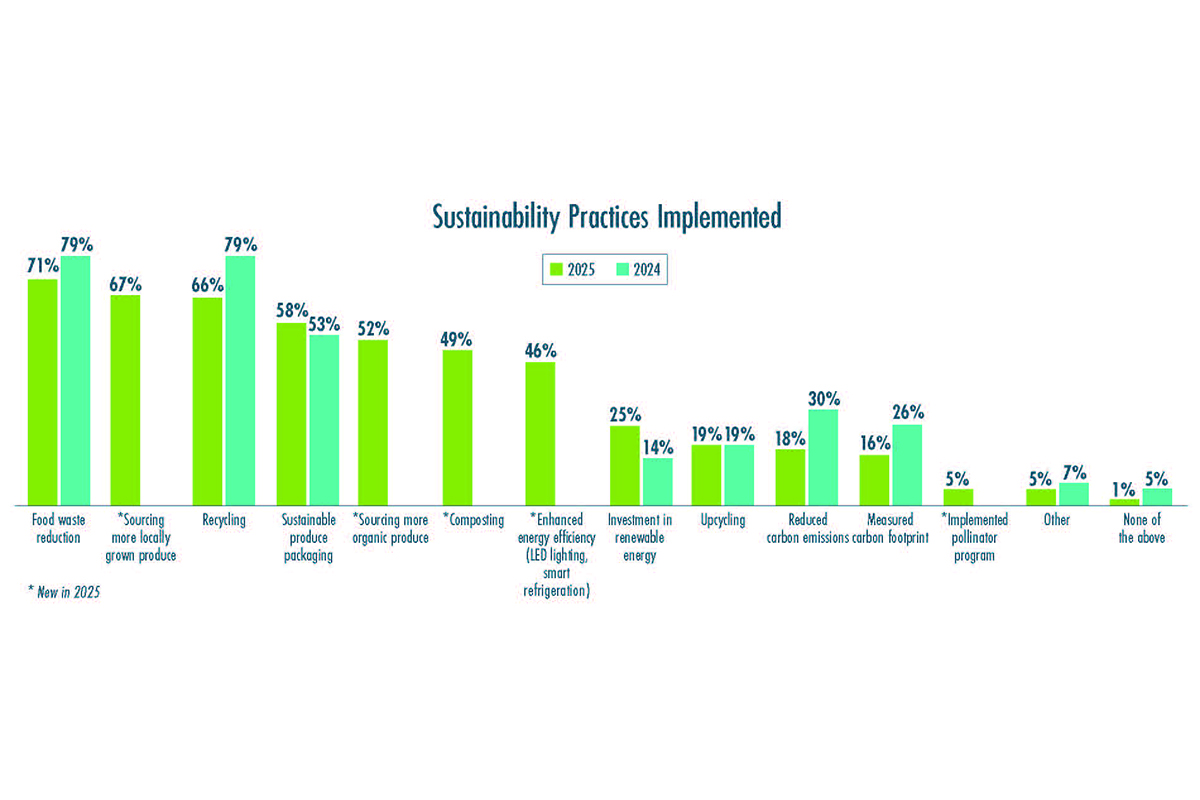

Nearly half (45%) of survey respondents implemented a new sustainable practice within the last year. Among the new practices implemented were: waste reduction and composting (43%), sustainable packaging (19%) and local/organic/regenerative sourcing (19%).

To communicate sustainability messages, over one-third (36%) of surveyed retailers use social media as their primary communication method regarding their sustainability efforts, while 34% of surveyed retailers primarily use in-store signage. Other methods used include websites, printed reports and circulars.

Packaging Priorities and Perceptions

Packaging continues to be one of the most visible and measurable ways for retailers to advance sustainability.

Sustainable packaging ranks highest in importance in ability to impact sustainability within the supply chain with recyclable (69%), biodegradable (65%) and compostable (61%) packaging scoring highest as extremely/very important. Biological inputs and reducing carbon emissions also ranked high for at least half of the respondents.

When it comes to cost-sharing, retailers see sustainability as a collective responsibility, with 77% reporting everyone should share the cost of sustainable packaging, up seven percentage points from the 2024 survey. Regarding price sharing, more than half of retailers surveyed (56%) believe grocers are very/somewhat likely to accept a small price increase for sustainable packaging; only 19% of retailers surveyed are skeptical (very/somewhat unlikely) of grocers' willingness to accept such a price increase.

Sustainability Insights 2025 survey results show that 63% of retailers think they are at least somewhat fairly compensated for the extra costs incurred from sustainable practices; 20% of respondents think they are fairly compensated, and another 43% think they are somewhat fairly compensated.

Retailers estimate most consumers are willing to pay at least a little more for sustainable packaging — 82% in 2025 compared to 72% in 2024 — but they tend to underestimate how much more certain shopper segments, especially younger demographics, are willing to pay.

Surveyed consumers show higher willingness to absorb larger price increases than retailers anticipate, suggesting a potential gap in pricing and marketing strategies.

In defining sustainable packaging, biodegradable and recyclable, both at 66%, continue to be the most highly recognized as sustainable packaging, with biodegradables rising one percentage point from the 2024 survey and recyclables rising eight percentage points. Made from post-recycled materials (54%, up from 42%), compostable (52%, up from 37%) and protective packaging (49%, up from 30%) all rose significantly in recognition from the 2024 survey.

In general, surveyed retailers continue to recognize all listed types of packaging as sustainable to some extent.

Food Waste Action — With Room to Grow

Retailers report strong efforts toward reducing food waste, and almost half have taken on a new sustainability practice in the past year.

Food waste reduction remains one of the strongest sustainability motivators for retailers. In 2025, 86% report donating food that would otherwise be wasted (84% in 2024). Nearly half (49%, up from 35% in 2024) partner with vendors who repurpose food and a similar proportion (48%) redirects surplus to in-store foodservice programs. However, only 8% currently partner with food waste reduction apps — suggesting an untapped potential for technology solutions.

Nearly half of respondents (48%) have set food waste reduction goals, down from 56% in 2024, but only a small share are using measurable, numeric targets to track progress (such as aiming for a specific percentage reduction year-over-year). The majority (28%) focus on process and inventory optimization rather than hard benchmarks, pointing to an opportunity for more concrete accountability measures.

Access Sustainability Insights 2025 here.