What is fresh produce's unique value proposition? It's a question many industry leaders say has remained largely unanswered for the consumer, and the time is ripe to change that. With multiple generations of consumers now shopping for fruits and vegetables, however, the value proposition can differ based on the demographic.

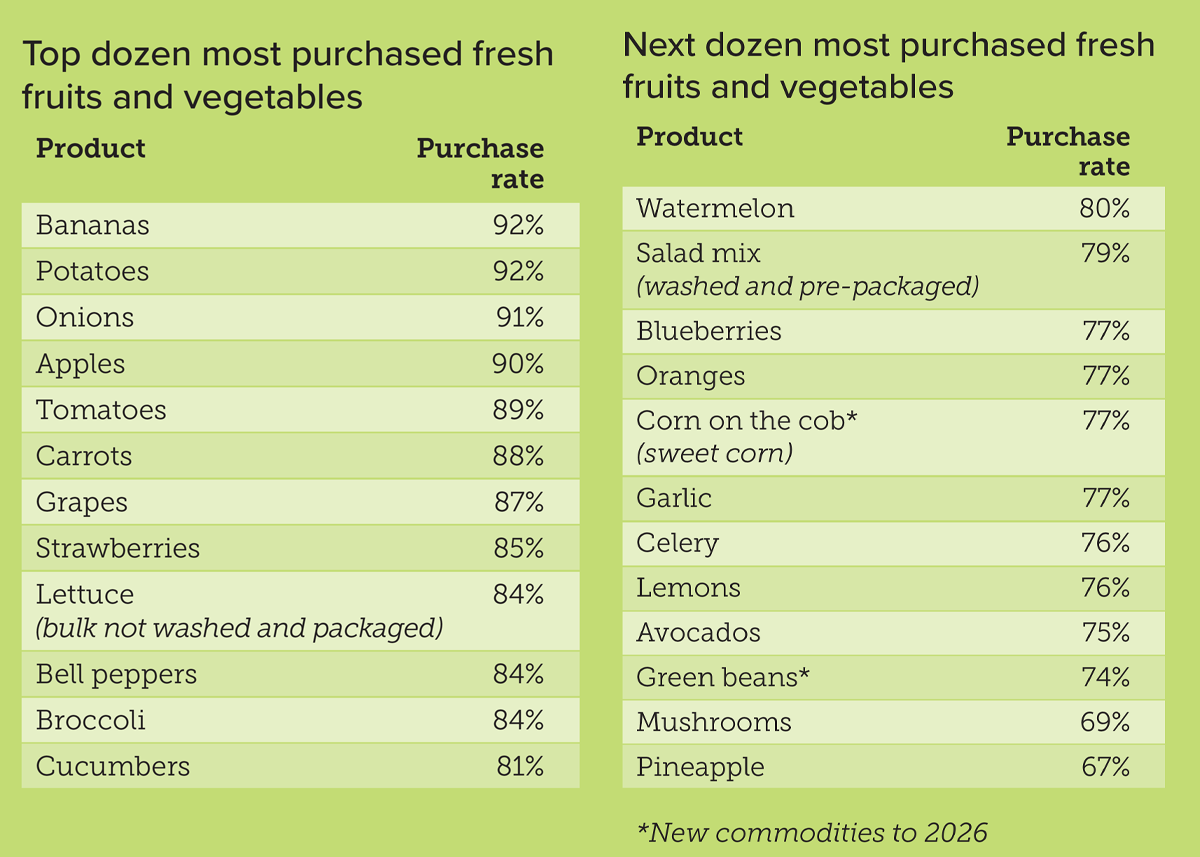

The Packer's Fresh Trends 2026 survey, conducted with research partner Prime46, asked more than 1,000 consumers across the country about their fresh produce buying habits in 50 commodities. What follows is a look at key shopper differences and trends, with the aim of identifying opportunities for growth and informing the industry's core value propositions.

Respondents represented all five generations, were 49% men and 51% women, and included households with dependent children and without as well as a range of annual incomes. A strong majority, or 75% of respondents, indicated they handle all or most of their household's grocery shopping.

Meeting the Male Shopper

While Fresh Trends 2025 shined a light on just how different younger shoppers' priorities are when purchasing fresh produce and how retailers and suppliers can best engage the critically important Gen Z and millennial generations, Fresh Trends 2026 reveals another consumer segment with opportunity for growth: men.

From organics to super-premium strawberries to purple sweetpotatoes and more, men reported higher purchase rates of differentiated produce items in the past 12 months than women. And, in general, they are willing to pay more than their female counterparts to get what they want.

When asked how their desire for healthy options weighs against their food budget, the majority of all respondents (59%) said they prefer to buy healthy options when the price feels right. But 18% of men indicated they buy healthy foods regardless of price, compared to 12% of women. Additionally, more men said they haven't noticed an increase in food prices.

How much more are consumers willing to pay for organic fresh fruits and vegetables over what they'd pay for conventionally grown? While 34% of all organic produce buyers indicated they are willing to pay up to 10% more and another 31% said they are comfortable paying 10% to 24% more, a small but notable 8% of men indicated a willingness to pay 50% more for organic fruits and vegetables, twice that of women at 4%.

Men's motivation for buying organic produce is also different. The majority of men, or 55%, said they bought organic produce for its nutrient content and health, versus 48% of women for whom food safety and avoiding chemicals were the leading drivers.

Given these gender-based differences, is produce missing out with men?

“Too often in this industry we think about mom [who] does all the grocery shopping,” says Jonna Parker, Circana's vice president, Fresh Foods Group. “We've got to remember that the average American household does not have children present full-time anymore. And there are a lot of male-led households with and without kids.”

Circana, which recently conducted an internal global study on the power of male-focused marketing and the male decision-maker, finds several socioeconomic trends, including delayed family start and the shifting role of marriage and division of labor throughout someone's adulthood, that have given rise to today's male shopper.

While Parker says produce is a little late to the party when it comes to understanding the male decision- maker, there's an opportunity to take a page from other category's playbooks like body care or vitamins and supplements.

“Men in 2025 are also more health-inclined than we might often give them credit for,” she says. “Think about something like the protein trend, which 41% of American consumers are trying to eat more protein. A big driver behind that is men looking to build muscle, looking to be healthier and leaner. When we talk about health trends, the male voice is very strong in that market.

“And look at innovation over the last two years in body care,” Parker continues. “Think about how many brands now are fully into every segment of the male life experience in body care and fragrance.”

Parker says more effectively reaching men through produce marketing is easier than one might think, a tweak versus an overhaul, even just including a male spokesperson can be highly effective.

“We're studying across our industries and produce that the little tweak has a ripple effect,” she says. “For those who say they still want to target that woman, 25 to 44 with two kids at home, we have proven in the last 10 years, that even if you put a male-as-caregiver imagery [in your marketing], it has a halo effect on women. In produce, we could easily just change out to show dad and his kids eating carrot sticks, and it wouldn't negatively affect women.

“But I also think what we've learned, especially on the health and wellness front, is men and women at different stages of their lives need different nutrients and different benefits, and so that's really the place where I think a little more work could be done,” Parker adds.

She says this can be achieved with different images and slightly different wording in the marketing.

In general, Parker says, men are a little deeper in their researching and linear in their decision- making, while women historically are a little more emotional and occasion-based in their shopping.

“Think about the rise of the meal prep trend,” she says. “Many, especially younger people, who are more health-minded, but primarily more male than female, are doing things like buying all their groceries in bulk and then spending half a day in meal prep. Women do that too, but more men do it.

“There's an example of something we could take into a retail format that could have a halo effect, a value effect on women, and especially men who are health minded,” she continues.

E-commerce is another channel where younger men might be more actively engaged than women, according to Parker.

“Too often in produce, we think that the world is still the baby boomer way of shopping,” she says. “And the reality is, anything that has continued growth in the last decade or two is much more likely to be male and younger than 20 years ago.”

Boosting Bananas

Fresh Trends 2026 finds that bananas (along with potatoes) are the most purchased produce item, with 92% of respondents indicating they bought the fruit in the past 12 months.

“Bananas have had a bit of a renaissance,” Parker says. “There was a moment where consumption and volume dipped earlier in the decade, and now you see an uptick in people saying bananas are one of their most popular purchased foods.”

Affordable and nutrient dense, bananas fit the healthy lifestyle trend and have become a routine purchase for many, Parker says. But with the right value proposition, there's opportunity for continued growth.

“Bananas are a great example of where, yes, women buy them and children love them, but looking at our data as well, they do skew male because of that routine, consistency, habit-forming behavior,” she says. “Putting them in the same conversation as nutrition bars, protein shakes and supplements is a great way to grow their consumption.”

“You're not alienating people who are already banana loyalists,” she adds. “You're just adding this new situation and consumer need that adds to the volume growth. Bananas are one of my favorite examples of taking something routine and adding some oomph or acceleration to it by thinking about it differently.”

Younger Shoppers Still Driving Different

Once again, Fresh Trends 2026 finds that Gen Z and millennials lead purchases of the new, different, organic and local.

From sweet snacking peppers and specialty mushrooms to jumbo blueberries and super- premium strawberries, Gen Z and millennials indicate they're putting more purchase power behind specialty items than other generations.

The survey data shows 17% of Gen Z and 16% of millennials said they bought sweet snacking peppers in the past 12 months, compared with just 9% of Gen X and 4% of baby boomers. Similarly, 15% of Gen Z, 11% of millennials and 10% of Gen X purchased specialty mushrooms (enoki, morel, oyster, lion's mane, etc.), compared with just 4% of baby boomers.

On the specialty-fruit front, 25% of Gen Z and 22% of millennials said they purchased Oishii-brand Koyo or Omakase strawberries in the past 12 months, versus 13% of Gen X and 4% of baby boomers. And a majority of Gen Z, or 55%, indicated a purchase of extra-large blueberries in that time frame, compared with 47% of millennials and Gen X, 37% of baby boomers and 29% of traditionalists.

Gen Z and millennials also reported the highest numbers of buying Cotton Candy grapes, the most purchased branded grape among respondents, at 41% and 39%, respectively, compared to 32% of Gen X, 19% of baby boomers and just 5% of traditionalists.

Just over a third of all respondents (36%) say buying locally grown produce is extremely or very important to them, with the strongest interest among Gen Z, millennials and Gen X as well as households with kids.

While millennials led overall organic purchase in some categories, such as avocados, more than twice the number of Gen Z respondents (30%) indicated organic purchases than Gen X (14%). Just 5% of baby boomers and 4% of traditionalists indicated organic avocado purchase.

Much of this growth is driven by innovation and reinvention, Parker says.

“Avocados have been a huge success story, and I don't see that slowing down,” says Parker, noting that the avocado industry had been struggling because crop conditions were producing smaller fruit until it started marketing bags of individual-size avocados.

“The consumer was like, ‘I love smaller avocados, and I don't have as much waste.' Now you see multiple sizes of avocados 52 weeks a year on the shelf.”

“Berries also have had 25 years of incredible volume growth, and I love to see that blackberries and jumbo blueberries are also tracking,” she continues. “It's about reinvention of the same commodity.”

Younger Shoppers Drive Organics Where They Buy

While the majority of consumers still predominantly purchase conventionally grown produce, among organic buyers, nearly one-third (30%) of respondents said 26% to 50% of their fruit and vegetable purchases are organic, a trend led by millennials.

Interestingly, where organic produce buyers shop differs by generation. Chain superstores such as Walmart and Target are the top sources indicated overall by respondents who purchase organic produce, with 48% of organic buyers shopping those stores. But among younger shoppers, that percentage is even higher.

Fifty-nine percent of Gen Z organic produce shoppers and 55% of millennials indicate they shop chain superstores for organic produce, compared with 48% of Gen X and 30% of baby boomers. No traditionalists surveyed indicated purchasing organics at a superstore.

“There's a reason that big chains went big on organics, and it's because of that nexus of next-gen consumer demanding that attribute,” Parker says. “Organic has also been a signal for many, many decades, and still to this day, to the average American consumer that you do care about produce when you carry more organic.”

Pound-for-Pound Value

Fresh Trends 2026 finds that while an overwhelming 82% of respondents think they're paying more for fresh fruits and vegetables than they were a year ago — a sentiment that is especially strong among households with annual income over $50,000, families with kids, Gen X and baby boomers — nearly two-thirds, or 63%, of respondents say their fresh produce consumption has stayed the same in the past 12 months or even slightly increased, despite rising prices.

“Produce has always been and remains the most cost-effective way to fuel your body, any which way you slice it,” Parker says. “The produce industry's inflation rate has gone up less than 20% on the average price per pound paid — double-digit lower than any other department's inflation rate.”

Fresh Trends reveals consumers are employing numerous tactics to manage their produce budget, from purchasing items on sale to buying in bulk and freezing to cutting back on specialty and value- added items.

On the flip side, one in five consumer respondents (20%) report buying more pre-cut produce, a trend led by Gen Z, millennials and families with children. The top reason (41%) that respondents say they're buying more pre-cut produce is convenience and time savings.

In the wake of rising food costs, nearly half of respondents (49%) say they are eating at home more often, a shift especially common among women, finds Fresh Trends 2026.

“We see the majority of consumers' meals, something like 78% to 80% of the calories the average American consumes, are sourced from home,” Parker says. “That remains the opportunity for produce. We sell commodities in large batches. We don't sell meal solutions.”

The produce industry needs to market to people wanting to eat healthier, more protein and nutrients, who are also consuming most of their food at home, she explains.

“How do we lean into that and show them how many meals you can get out of two pounds of potatoes?” Parker says. “How do we show them the versatility of a clamshell of cocktail-size tomatoes that can go on salads, be a snack or an ingredient in your pasta that night?

“I haven't seen us lean into our story on price per ounce, price per eating occasion or price per use, which is very common now in how we market other foods,” she adds. “If we brought that kind of concept to produce, the dollars would follow.”

Produce also needs to get more strategic about whom they're talking with and how they're talking about these value propositions, Parker says.

“We see brands now investing in influencers and digital media,” she says. “We see retailers with recipes and searchable AI on their apps, and we're talking about agentic commerce now. If I want my kids to eat more vegetables, I'm going to get served with all these ideas; how are we playing into that?”

Fueling America: A Value Proposition

When it comes to communicating the value of produce, it's about way more than price, Parker says.

“We have to talk about our value in terms of fueling America, our value in terms of snacking, our value in terms of meal making; all three of those things are what consumers consider relevant today as they eat smaller and more frequent meals,” she says.

While consumers are trained for deal hunting and looking for sales in the highly perishable and weather-dependent produce arena, you can't put everything on sale all the time.

Instead of thinking sales, the produce industry needs to be thinking occasions, situations and consumer cohorts for whom fresh produce resonates most, Parker says. “If we do that, sale or not, we'll drive volume.”

“I'm ending this year looking at the numbers,” she continues. “We did good. High-five produce. We got pound growth,

and our pound growth is outpacing that of the total food and beverage. But when you look at your survey and how much momentum and interest there is in our industry from the younger generations, our growth rates should be so much higher, because we've got a generation of people where produce is incredibly relevant, whether it's organic or not.”

In honing the fresh produce value proposition, Parker sees opportunity for the brands, varieties and package types that uniquely appeal to each segment of produce shopper.

“We have to get away from our own bias that produce doesn't need to be marketed,” she says. “Because I think you can take a mushroom or a tomato and end up continuing to see growth from your loyal [Gen] Xers and [baby] boomers while you're simultaneously growing volume with the next generation that has to be reached through a different kind of marketing than what we're doing today.”

Download the full report here.