When Jackie Suggitt, vice president of business initiatives and community engagement for the U.S. Food Waste Pact, describes the pact's methodology, she begins with its backbone: target, measure, act.

“The order is really important,” Suggitt says. “You don't want to jump straight from target to act without the measurement to guide the action.”

Only when a business commits, measures and reports its food waste can the pact “take that data and do something with it to actually reduce food waste.”

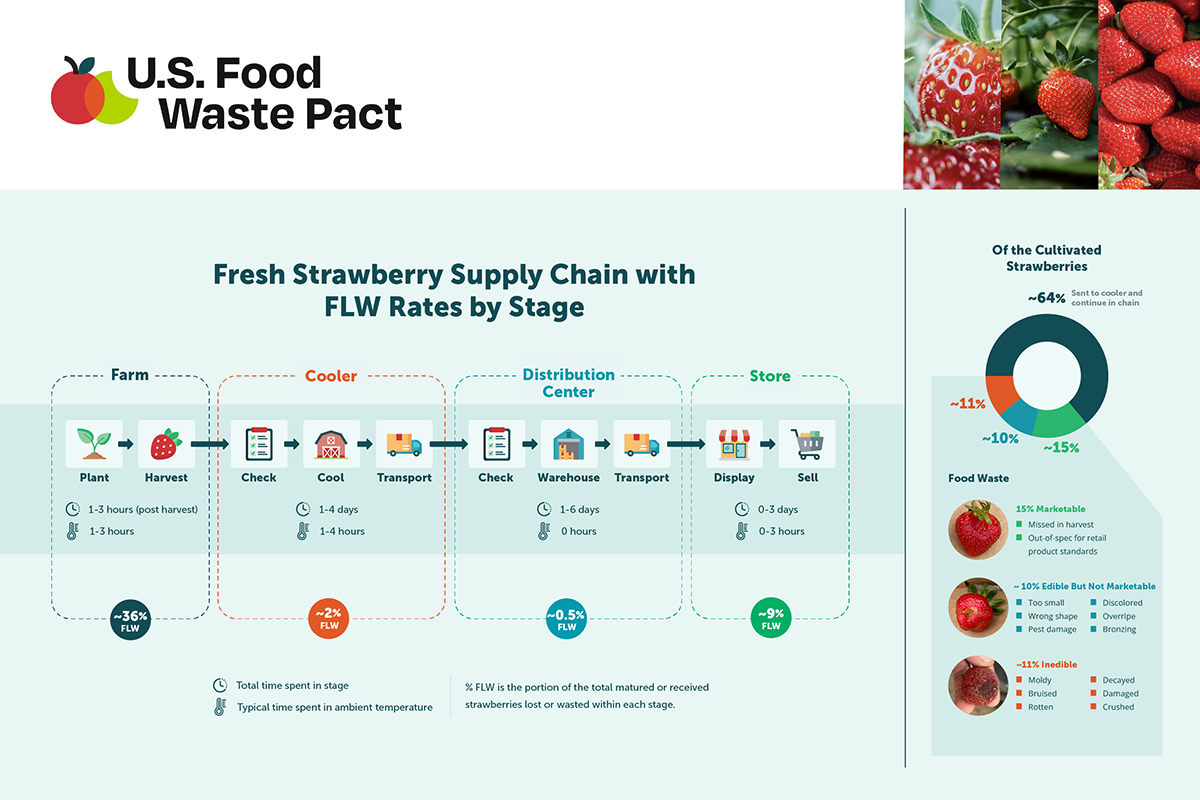

That philosophy — data first, action second — is shaping how retailers and growers collaborate today, especially in the specialty-crop supply chain. Few examples illustrate that impact more clearly than the pact's strawberry whole-chain pilot, detailed in the Pacific Coast Food Waste Commitment strawberry case study.

Shining a Light on Hidden Losses: The Strawberry Case Study

Fresh strawberries represent one of the most waste-vulnerable crops in the U.S. supply chain, Suggitt says: fragile, highly perishable and grown at massive scale.

The pact's strawberry pilot followed fruit from farm to retail across two seasons, and the results were eye-opening:

- Thirty-six percent of mature strawberries were left unharvested, often due to leaf cover, labor pressure or retailer specifications.

- At retail, about 9% of strawberries went unsold because of shelf-life issues, quality standards or demand planning.

For Suggitt, this is exactly why the pact exists.

“We went and said, ‘Let's go look everywhere, from farm to retail. What the heck is happening with strawberries? Where are they going to waste and why?'” she says. “Phase 1 is all about highlighting hot spots.”

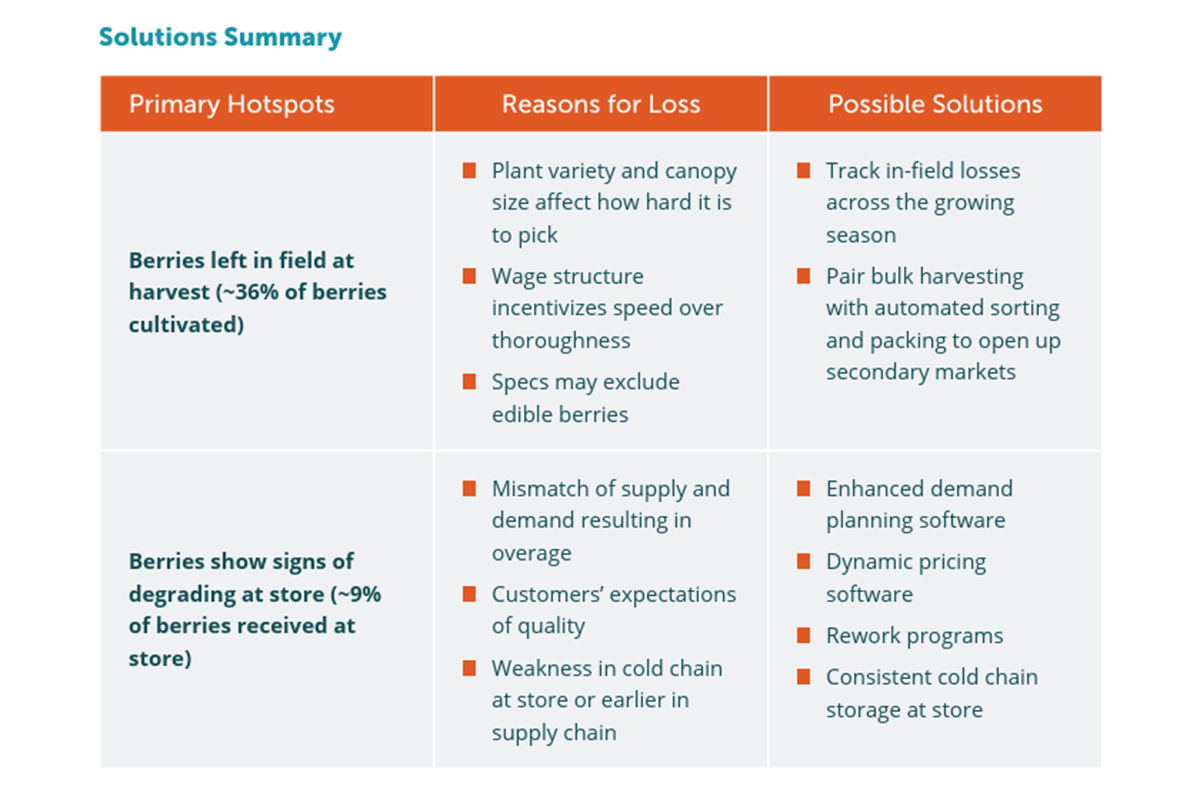

Those hot spots became the starting point for real change.

Influencing Farming Practices: Turning Unharvested Fruit Into Value

Historically, unharvested strawberries were seen as an unavoidable loss. Growers focused on marketable fruit, and without data, many didn't realize how much edible product was being left behind.

“The power in that is no one of those individual stakeholders could have solved that problem on their own,” Suggitt says. “It had to be the grower and the broker and the buyer all coming to terms on a new market strategy.”

In the strawberry pilot:

- Growers began monitoring in-field losses, recognizing edible fruit they had never counted before.

- Bulk harvesting and secondary-market sorting were explored as ways to reclaim “edible but out-of-spec” berries.

- Some berries were rerouted to new buyers who weren't constrained by retail appearance standards.

Suggitt says that this wasn't a grower problem as the losses stemmed from systemic market specifications and incentives.

“A retailer alone can't fix that,” she says. “A farmer alone can't fix that.”

The pact's role, she says, is to convene, diagnose and help reshape those market dynamics.

Retail's Role: From Ordering Technology to Creative Uses of Imperfect Fruit

Retailers sit at a pivotal point in the chain, and they are among the pact's most active participants.

“We have over 50% of market share,” Suggitt says, citing retail signatories such as Walmart, Kroger, Albertsons, Aldi, Sprouts and New Seasons.

Suggitt says e-tailers' motivations are multifaceted:

- They want to maximize sales and reduce shrink.

- They want better shelf life and fresher perception with customers.

- They want consistency and efficiency in supplier partnerships.

Many of the strawberry case studies recommended retail strategies reflect current Pact-aligned efforts, including:

Smarter Ordering and Demand Planning

Retailers are investing in predictive analytics to prevent overstocking. In the strawberry pilot, one retailer using demand-planning tools reduced strawberry waste by 15.5%.

Reworking and Salvaging Product

Some retailers now “rework” clamshells, removing a few damaged berries to salvage the rest for sale or donation.

Suggitt points to one particularly successful example: “Walmart partnered through their private brands to actually take off-spec strawberries that were too small and turn them into Great Value jam,” she says.

This partnership created a new revenue stream for growers and reduced field-level waste without resorting to donation or processing at commodity prices.

“It's not food that even needs to be donated,” Suggitt says. “This can be a marketable, salable food for us.”

Suggitt stresses retailers also need to align with each other, and not just with growers.

“If seven different retailers are asking for seven different things, that's really hard on a supplier,” she says.

The pact, she says, helps retailers create common approaches that reduce the burden on growers.

Engaging Growers Directly: The Western Growers Partnership

The pact's reach is expanding upstream. In addition to Del Monte and Midwest Foods, the pact recently welcomed Western Growers as a coalition partner.

“We're really excited to have Western Growers join,” Suggitt says. “If we're going to tackle a systemic issue, we need the whole system at the table. Growers are a really important voice.”

Because Western Growers represents hundreds of producers, the pact can now funnel solutions to a much wider audience.

“It's an amplification and scaling mechanism,” Suggitt says. “It lets us take the things we're learning and testing and really bring those to scale.”

Why It Matters: A More Efficient, More Profitable, Less Wasteful Supply Chain

The integration of growers, retailers, suppliers and service providers is central to the pact's success. By using shared data, common standards and joint pilot projects, participants gain clarity on which interventions truly reduce waste and which simply shift it around.

“Here's the shared problem. Here's a solution that we think is worth exploring. Go figure it out,” Suggitt says.

And when they do, Suggitt says the results, like the strawberry pilot, show that reducing food waste doesn't just benefit the environment. It increases margins, strengthens supply chain resilience and ensures more of the crop farmers work so hard to grow actually reaches consumers.