Bananas are something of an enigma of produce purchasing in the U.S.

On the one hand, they are one of Americans' favorite fruits. According to the International Fresh Produce Association, bananas were the most consumed fruit in the U.S. in 2023. In The Packer's Fresh Trends 2025 report, 81% of respondents reported buying bananas in the previous year, eclipsing even apples (80%).

There's also a lot of them to go around. According to USDA Economic Resource Service's noncitrus fruit yearbook, there were 26.7 pounds of bananas available per person in 2023 (most recent complete data). This compares to the 17.9 pounds of apples available per person. Plus, bananas are not only the most purchased fruit by both frequency and volume, but they are the most commonly purchased item in the entire grocery store, representing about 1% of all sales.

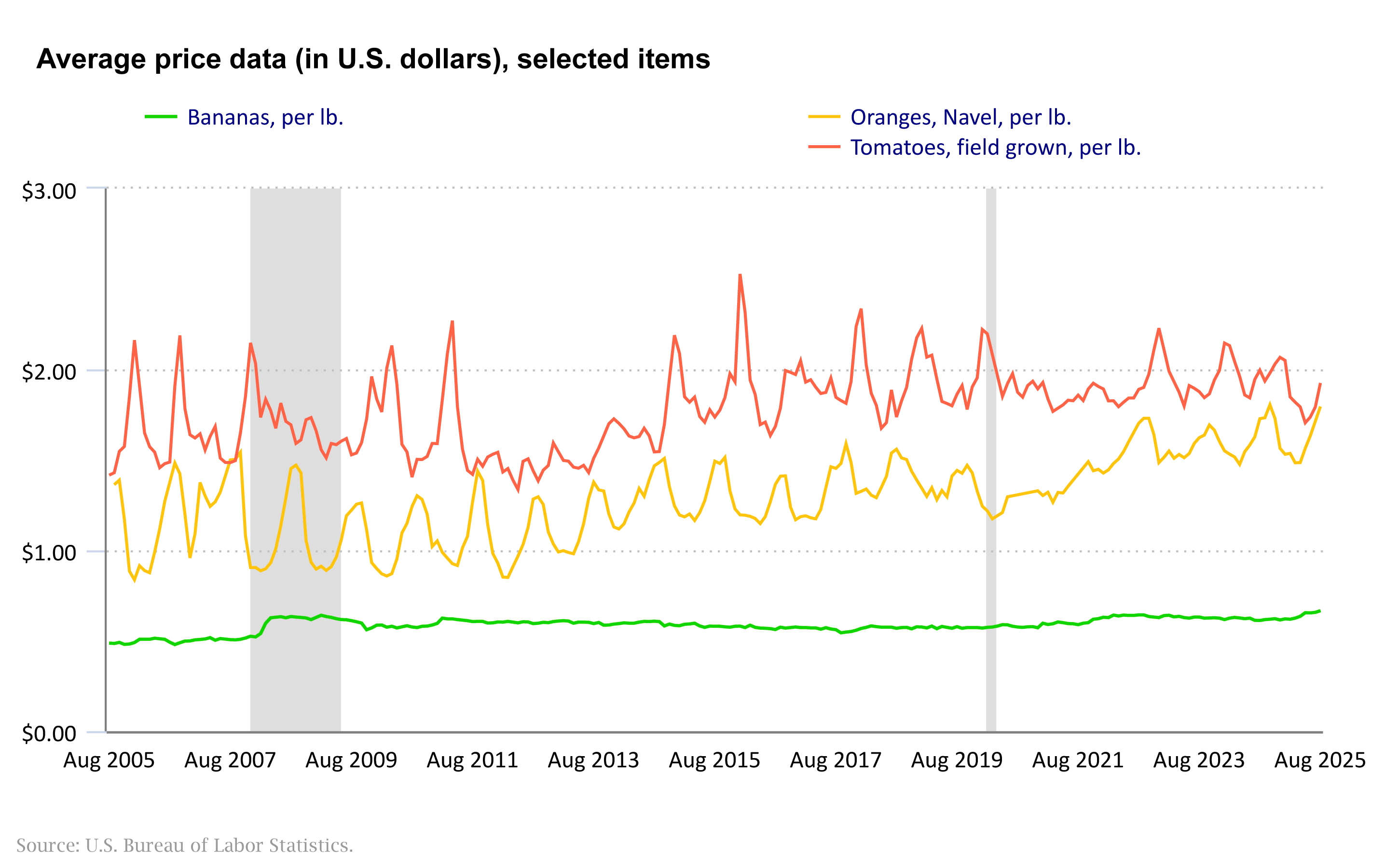

Speaking of sales, bananas are also spectacularly cheap. According to USDA ERS data, the average price of apples in 2022 (most recent complete comparative data) was $1.85 per pound. For bananas, it was 60 cents. And, unlike local produce that sees seasonal price fluctuations, banana prices stay remarkably stable. According to the Bureau of Labor Statistics, the average price of bananas in August 2025 was 67 cents per pound and has remained relatively flat for decades.

On the other hand, the banana is such a must-have staple to so many people, that picking up a bunch is almost automatic. And therein lies a problem.

“One of the biggest marketing challenges for bananas is that many shoppers perceive them as a routine, or even a boring purchase,” says Ahiby Rodriguez, trade marketing manager for Fyffes North America. “Since bananas have become such a staple in shoppers' shopping lists, the category has lost excitement or the emotional connection with shoppers.”

But there is excitement to be had with the banana, just not necessarily always the good kind. Weather and climate challenges, international trade issues, spreading diseases and the shifting trends in consumer interest are all poised to shake things up when it comes to banana marketing.

Global Supplies Mean Global Challenges

While bananas, particularly the familiar cavendish variety, are the most popular fruit in the U.S., they are also the most popular fruit in the world. The Food and Agriculture Organization of the United Nations notes that “bananas are among the most produced, traded and consumed fruits globally,” with the cavendish representing just under half of global production and the most traded.

FAO's most recent Banana Market Review described the U.S. as one of the top destinations of the world's bananas, consuming almost 22% of global banana imports. This makes it second behind the European Union (28%) and ahead of China (9%) and Russia (6.1%). According to ERS, the U.S. has imported all of its bananas since 2012, with 85% of that total coming from Guatemala (41%), Ecuador (19%), Costa Rica (16%) and Honduras (9%).

Together, these details mean U.S. banana availability — and potentially price — can be impacted by global issues.

“Global climate change and extreme weather, particularly in Honduras, are reducing production, forcing significant new investment in water management,” notes William Goldfield, director of communications at Dole.

FAO similarly reported weather-related issues in Guatemala in 2024, citing Hurricane Beryl in July as having destroyed planted banana acres and damaging the quality of those supplies that remained. The result was a 3.5% decline in Guatemalan banana shipments in 2024.

According to ERS, weather, specifically La Niña-related cool weather in Central America, has reduced banana imports into the U.S. in the first five months of 2025 compared to the same time in 2024.

But global trade conditions are also playing a role in current conditions. According to Goldfield: “geopolitical factors, import duties and tariffs, and increased demand from Asia and Eastern Europe are impacting market availability and needs for spot purchasing in Ecuador. All of these factors have disrupted available supply this year and we expect this trend to continue in 2026.”

The TR4 Threat

One banana challenge that is guaranteed to continue into the future is the spread of disease, particularly the latest strain of the fusarium wilt fungus, best known as Tropical Race 4, which threatens global cavendish production.

According to FAO, TR4 has been confirmed in 24 countries across South and Southeast Asia, the Middle East, Africa, Oceania and Latin America, including Colombia, Peru and Venezuela. The fungus causes production losses where it exists. It can also cause substantial costs where it doesn't exist, as resource- and labor-intensive preventive efforts are growers' primary strategy since “no effective fungicide or other eradication method is currently available.”

“Dole and other producers continue to search solutions to the challenge caused by TR4,” Goldfield says. “The industry has been doing a good job containing the propagation of TR4 so far, but unfortunately, TR4 has just recently been reported in Ecuador, the largest banana exporter in the world, increasing the urgency to discover solutions.”

He adds that, while banana prices in the U.S. will ultimately be driven by supply and demand, “because TR4 has the potential to eliminate infected plantations and leave them out of production for 20-plus years, operations costs will reflect the immediate and necessary investment in infrastructure and research to successfully contain the TR4 spread.”

Rodriguez says the industry has made important progress towards that effort through disease prevention and “protective farming practices,” but still calls the disease “one of the most serious challenges for global banana production.”

FAO similarly characterized the disease. It added, however: “Some breakthroughs in the engineering of resistant varieties have been achieved recently, but it remains to be seen if traders, retailers and consumers will accept these new varieties.”

Opportunities in New Varieties

Luckily for banana marketers, consumers seem receptive to new varieties and other value-added characteristics like organic or fair trade.

Both Rodriguez and Goldfield report that consumers have a growing interest in more exotic banana varieties. These include red bananas, baby bananas (also known as “lady fingers”), burro bananas, manzanos and plantains. This being driven not only by the companies' need to diversify in the face of threats like TR4 but also by shifting consumer food interests.

“This trend is being driven by the influence of multicultural cuisines and by consumers seeking new flavors and snacking experiences within the category,” Rodriguez says.

Goldfield agrees, saying consumer demand for “spicier, more exotic and flavorful foods, dishes and recipes” is driving gains in the exotic banana category.

“Plantains lead the exotics category in sales growth and increased 8% in 2025 alone in spite of supply disruptions — the result of more aggressive promotion at Dole and other producers as well as Latin-inspired flavors continuing to move into the mainstream of North American eating habits,” he says.

Goldfield sees “increased widespread promotion of new varieties and organic” as the biggest banana marketing trend for the future. It's one dictated as much by consumer interest as industry necessity in the face of TR4, he adds.

“You can see this in last year's ‘Swicy' food trend, which featured a resurgence of foods and drinks combining sweet and spicy flavors,” he says. “At Dole, we leveraged this ‘swicy' trend with recipes like our Sweet and Spicy Plantain Soup and Sweet and Spicy Tamarindo Dole Whip, both made with Dole plantains.”

Goldfield says that while Dole used to position its more exotic varieties to “younger, more adventurous consumers,” the trend is catching on with more mainstream American banana lovers as well.

Organic, Fair Trade and Beyond

Another banana trend that is led by younger consumers but is catching on with all banana consumers is increasing interest in organic bananas.

According to The Packer's Fresh Trends 2025 report, the youngest shoppers (aged 18 to 29) reported they were as likely to buy organic bananas as they were to buy conventional. For those aged 30 to 39, the trend was very similar. Reports of organic banana buying declined as the age of the respondent increased, but they have stayed steady or increased year over year in all categories recently.

ERS data supports this overall growth in organic bananas. In 2024, roughly 13% of bananas coming into the U.S. were certified organic compared to about 7% a decade earlier.

“Today, organics represent approximately 16% of retail banana volume sales and its demand continues to rise double digits every year,” says Rodriguez, citing Circana data through early September 2025. She adds consumers, particularly Gen Z and younger millennials, are value-driven and “care about where their food comes from and how it's produced.”

Kim Chackal, vice president of sales and marketing and co-owner of Equifruit, agrees with this perspective, noting that consumers are increasingly voting with their dollars by buying organic.

“Even if the price differential between conventional and organics is marginal, [consumers are] still choosing that product more and more and more,” she says. That leads the company to ask if consumers are just interest in organic or if they are also concerned with better farming practices, Chackal says. Equifruit has assumed “yes,” importing only Fairtrade Certified bananas into Canada and a few outlets in New York.

Both the company and fair trade bananas have seen impressive growth in Canada. According to Fairtrade Canada, Fairtrade Certified bananas have seen 524% growth between 2019 and 2024. Equifruit has similarly seen impressive growth lately. It was again named one of Canada's top growing companies by The Globe and Mail with a growth rate of 195% in 2025.

Fair trade bananas have not had quite the same success in the U.S. but are still a growing category, according to both Goldfield and Rodriguez. Both Dole and Fyffes offer fair trade bananas.

“Fairtrade is still developing in the U.S. and compared to Europe, we still have a long way to go,” says Rodriguez, adding that it is an opportunity to further educate consumers on sustainability. That conversation is the way of the marketing future too, she says.

“In the future, banana marketing will be about connection and transparency,” Rodriguez adds. “TR4 keeps reminding us how important it is to tell the story behind every banana on the table, the care, dedication and sustainability efforts that go into growing it.”

This can help recapture some of that lost excitement or emotional connection, she adds, especially if paired with effective and eye-catching merchandising such as secondary displays placed in high-traffic areas or near complementary categories.

“Being the No. 1 favorite fruit also challenges us to communicate our sustainability efforts in a more engaging way,” Rodriguez says.

“By sharing our sustainability journey and the steps we're taking to secure the future of bananas, we can strengthen trust and the emotional connection with shoppers while continuing to deliver the fruit they love,” she adds.