LAS VEGAS — GLP-1 drugs are reshaping consumer behavior, and the grocery industry needs to catch up.

That was the message from Leigh O'Donnell, who leads shopper and category insights for Kantar North America, during her session “GLP-1's Lasting Impact on Consumer Preferences” at Groceryshop 2025 last week. O'Donnell shared new research on how these medications, used for diabetes and weight management, are creating lasting shifts in eating, shopping and wellness habits that will redefine retail strategies.

O'Donnell says the market for GLP-1 medications, projected by Morgan Stanley to reach $150 billion globally by 2030, is already influencing how Americans buy food. In Kantar's research, households with a GLP-1 user spent about 6% less on groceries in the first six months of use compared with nonusers. As the category grows — with an estimated 20% of eligible Americans expected to be on these drugs within a decade — that shift will have broad implications across categories.

“This isn't a fad,” O'Donnell says. “GLP-1s aren't another diet trend; they're fundamentally changing how people experience hunger, make choices and define wellness.”

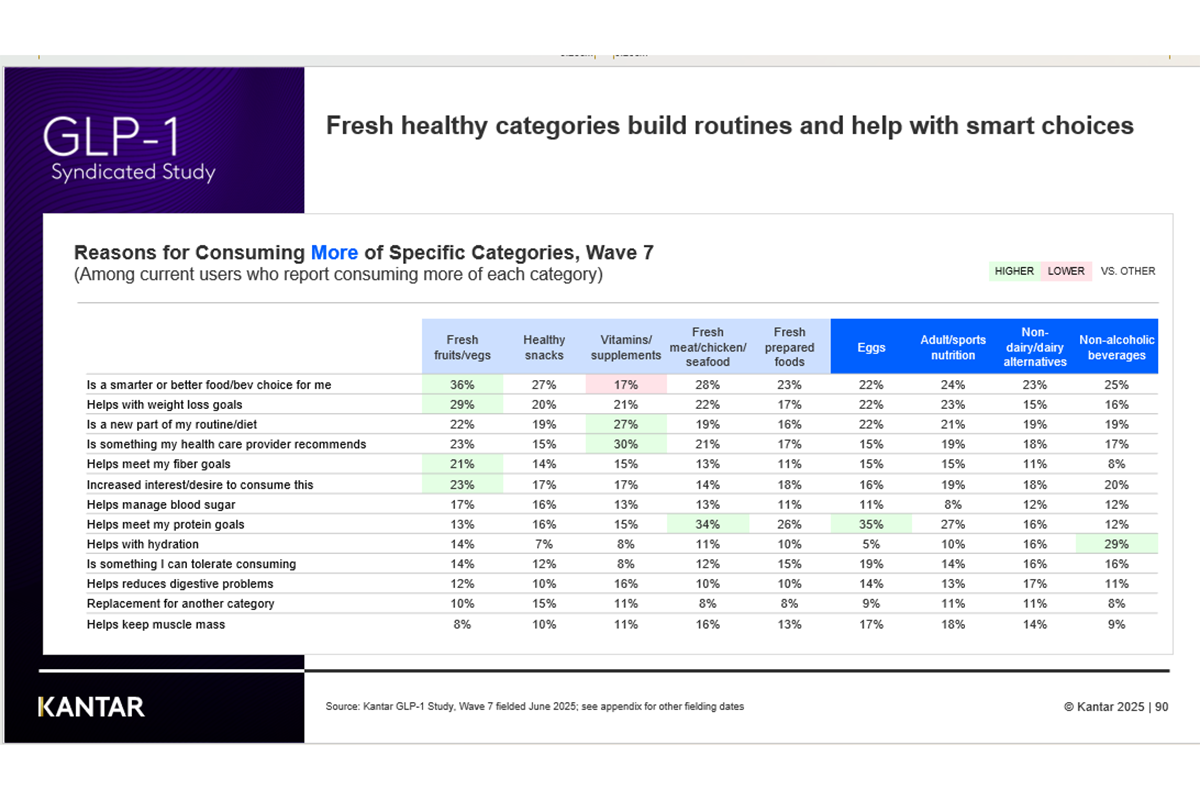

She explained that many GLP-1 users report less “head hunger” or emotional eating, meaning they think more deliberately about each food purchase.

“GLP-1s make shoppers shop slowly, think slowly,” she says. “They're reading labels, comparing nutrition and making more intentional choices.”

That shift has already begun to disrupt grocery loyalty. According to Kantar's data, 46% of GLP-1 users say they have a new go-to retailer, often because they're seeking stores that better support their evolving dietary needs. O'Donnell emphasized this as a major opportunity for grocers to rethink shelf strategy and in-store messaging.

“What do you want your brands to say when shoppers are thinking slowly — when they stop to look again at your product?” she says.

Another critical point, she says, is that GLP-1 users are not monolithic. While 43% report making “better choices,” many still seek moments of indulgence.

“They're not sitting in dark rooms eating bits of cardboard,” O'Donnell says. “There's still room for joy. Retailers should balance health-driven messaging with cues that celebrate flavor and satisfaction.”

To meet this growing segment's needs, O'Donnell urges retailers and brands to educate themselves — and their teams — about what she called “modern wellness.” She says grocers must understand the nuances of appetite regulation, nutritional balance and even common side effects, such as digestive discomfort, that affect what GLP-1 users buy.

“There's still so much white space in the market,” she says. “Most major retailers don't yet have an in-store or shelf strategy that addresses GLP-1 users. It's time to get educated.”

Modern wellness can cover a lot of things, O'Donnell says, but of those people who've switched retailers, the top five things they want from a retailer include:

- Higher quality groceries.

- Carries organic.

- Unique products I can't get elsewhere.

- Has a reputation of being a health and wellness resource.

- Rewards me for making healthy choices.

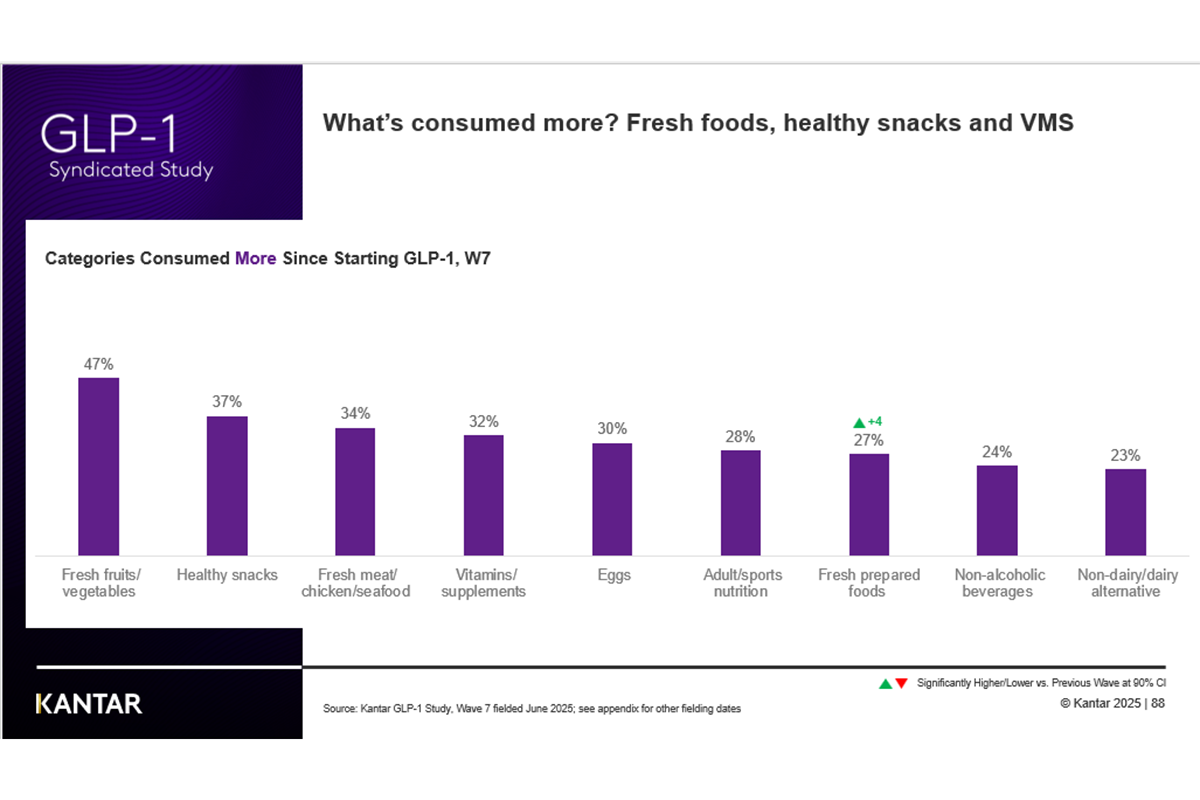

O'Donnell's message aligns with broader shifts already visible in consumer data. According to The Packer's Fresh Trends 2025 report, shoppers continue to prioritize foods they perceive as healthy, fresh and minimally processed — even outside of the GLP-1 audience. Even so, 84% of consumers taking GLP-1 medication indicate they have increased their produce consumption.

At Groceryshop, The Packer met up with Amanda Oren, RELEX's vice president of industry strategy for grocery in North America, to get her take on how retailers are preparing or adapting shelf strategies.

“There are very clear preferences that are being seen,” Oren says. “From what I've read, 6% to 8% of the population right now are on GLP-1s, but 12% have been in the last year. That's a really high number.

“And their habits are drastically different when they're on it. There's a lot of research being done on whether or not the habits stay or not, but the main habit is that more fresh produce is being purchased, a lot more proteins, so the meat and seafood departments are spiking as a result, and then obviously the salty and sweet snacks are on the decline,” Oren adds.

A new report from Sunlight finds that Americans using GLP-1 medications such as Ozempic and Wegovy are not only losing weight, but also significantly reducing their household food spending. The study, which surveyed 1,200 current GLP-1 users in September, shows average monthly food and diet-related costs fell $218 per month — nearly 30%, according to a news release.

The drop in spending was consistent across food-related categories. Respondents reported trimming their grocery bills from $351 to $282, reducing spending on restaurants and bars from $183 to $127 and cutting fast food and snack purchases from $183 to $106. Additionally, spending on diet programs declined, from $95 to $78, while fitness expenses remained virtually unchanged.

When factoring in the average out-of-pocket cost of GLP-1s, which respondents reported at $176 per month, the majority of users still came out ahead financially. On average, people netted a savings of about $42 each month, or more than $500 annually.

The survey also revealed that cost savings were part of the motivation for some patients. One in three respondents said they considered potential savings when deciding to start a GLP-1 prescription, with Gen Z adults especially likely to cite financial reasons alongside health outcomes.

“It's certainly the new GLP-1 economy as we call it,” says Angela Tran, CEO and founder of Med-Fit Medical Weight Loss. “On average, GLP-1s can lead to 15% or more body weight reduction, and for those who have lived with obesity for years, their lives will change dramatically. GLP-1s lead to less spending on food, with users eating smaller portions, cutting unnecessary snacking, finding fast food less appealing and experiencing reduced cravings for high-sugar foods.”

O'Donnell concluded the Grocershop session by saying that retailers who act early — by tailoring assortments, messaging and education to this new health-conscious but joy-seeking shopper — will be best positioned for growth.

“Whether your brand is a headwind or a tailwind in this trend,” she says, “there's a way to connect with GLP-1 users if you understand how they think about food, wellness and satisfaction.”