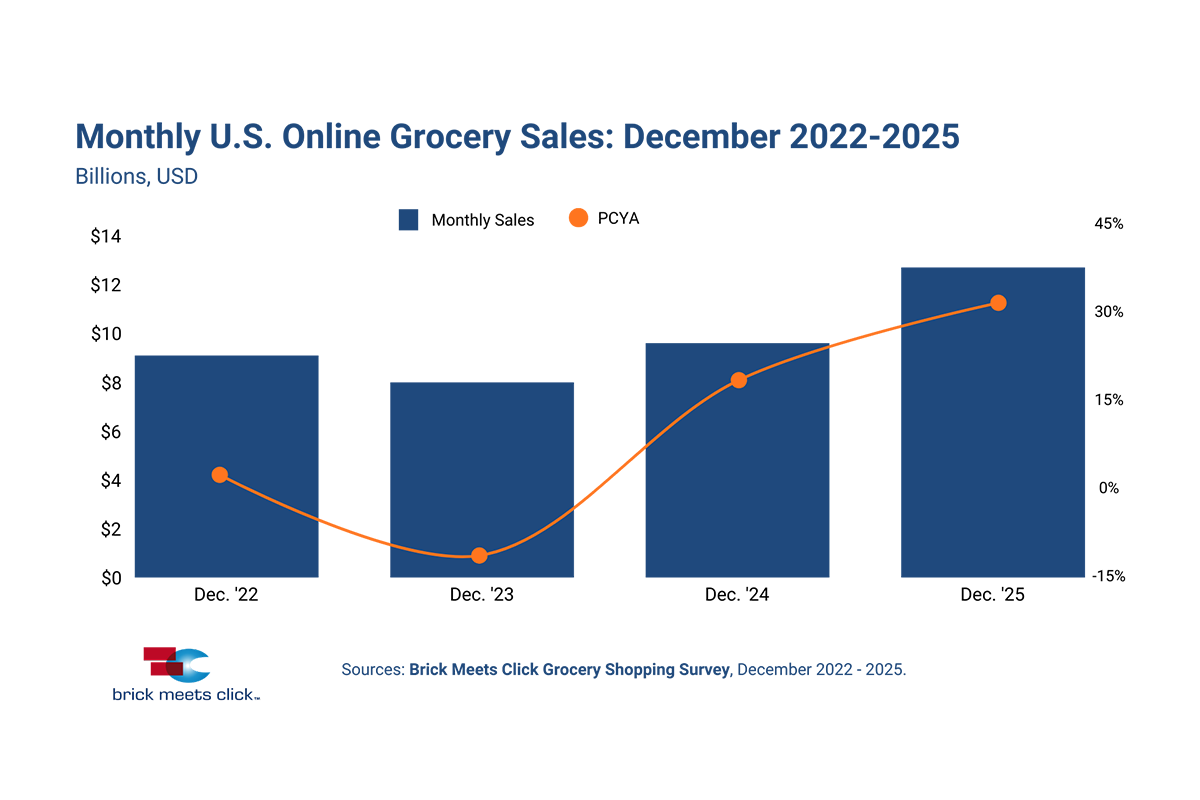

Monthly U.S. online grocery sales accelerated dramatically in December, with total sales surging 32% year-over-year to finish the month with a record high $12.7 billion, according to the latest Brick Meets Click Grocery Shopper Survey.

This robust performance reflects higher order frequency, spending rates and a larger user base than December 2024, the survey shows.

“December set a record high for monthly e-grocery sales, closing out the year with a bang, although gains were unevenly distributed across formats and banners,” says David Bishop, partner for Brick Meets Click. “Structural shifts in shopping behavior drove much of e-grocery’s growth in 2025, and this will create stiffer headwinds in 2026 — especially for regional grocers.”

Order frequency, which measures the average number of orders completed by monthly active users, climbed year-over-year for the 16th consecutive month in December, increasing 8% versus last year. MAUs completed an average of 2.9 orders during the month, and more than half of MAUs completed three or more orders, breaking the record set last month. The core 30-to-44-year-old age group posted the biggest increase, jumping 17% versus last year and completing an average of 3.2 orders during the month.

The share of MAUs that chose to receive e-grocery orders via multiple receiving methods (delivery, pickup and/or ship-to-home) rose rapidly in December, while the share that used only one method continued to contract. So, while the overall e-grocery MAU base expanded by about 10% during December, each receiving method experienced larger year-over-year gains in its specific MAU base.

The average order value for e-grocery orders across all three fulfillment methods climbed nearly 11% in December 2025 compared to last year. Ship-to-home posted the strongest gain at 14%, boosted by the continued rollout of Amazon’s same-day fresh grocery service. Pickup and delivery trailed slightly, with each gaining 9%. For delivery and pickup (combined), the mass and supermarket formats each posted 8% spending gains compared to last year.

Online share of weekly grocery spending in December 2025 was the highest since May 2020, and ended the month at 19%, an increase of 430 basis points versus December 2024. The share expansion was fueled by higher year-over-year spending rates across all age groups and market sizes with medium metros posting a significant jump due to growth in delivery. Online share of grocery spending rose for all income levels except households making $50,000 to $99,999, which reported a slight pullback versus last year. The $200,000-plus group (~16% of U.S. households) has nearly doubled its online spending since December 2023.

The Brick Meets Click Grocery Shopping Survey’s three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider such as Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home includes orders that are received via a common carrier or contract courier like FedEx, UPS, USPS, etc.