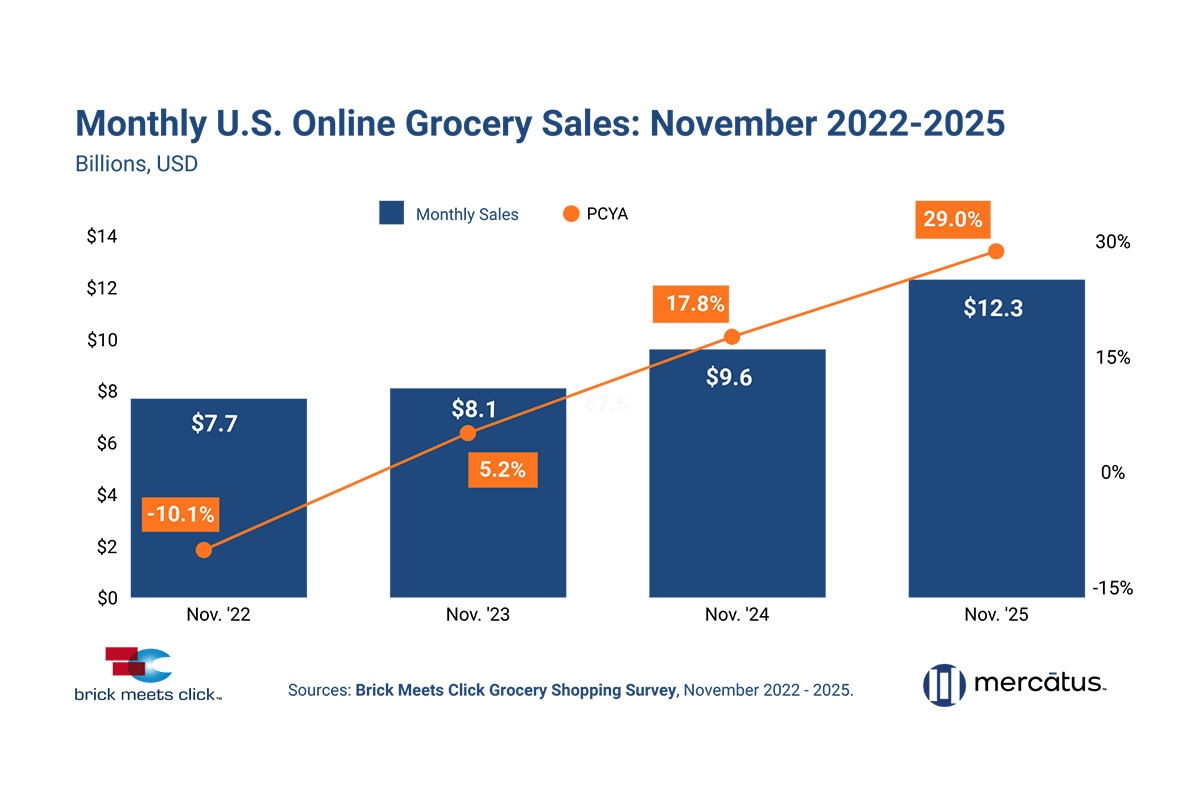

Monthly U.S. online grocery sales experienced a dramatic acceleration in November, with total sales surging 29% year-over-year to finish the month at $12.3 billion, according to the Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

E-grocery’s strong performance in November was driven mainly by higher order frequency, increased use of multiple receiving methods and higher spending rates, which helped e-grocery account for a larger share of total grocery spending compared to last year.

“November 2025 results mark a strong rebound versus the moderate growth reported for October when the U.S. government was shut down during the entire month,” says David Bishop, partner for Brick Meets Click. “The overall growth rate for e-grocery has accelerated each November since 2022.”

Order frequency, which measures the average number of orders completed by monthly active users, climbed year-over-year for the 15th consecutive month, increasing 12% versus last year with MAUs completing an average of 2.8 orders during November 2025. The share of MAUs completing three or more orders during the month set a record high, with nearly half of MAUs falling into this high frequency group. While all age groups reported gains in order frequency, the core user group (30-to-44-year-old households) posted the strongest increase, surging over 20% versus last year and completing 3.1 orders on average during the month.

The share of MAUs that chose to receive e-grocery orders via two or all three receiving methods (delivery, pickup and/or ship-to-home) rose rapidly in November, as the share relying on only one method finished at one of its lowest levels since tracking began. So while the overall e-grocery MAU base expanded in the mid-single digits during the month, shifts in shopping behaviors enabled each method to experience double-digit gains in its specific MAU base.

The average value for e-grocery orders climbed 11% in November 2025 compared to last year. Ship-to-home posted the strongest year-over-year gains at 12%, aided by the continued rollout of Amazon’s same-day fresh grocery service. Pickup posted solid gains of 11%, and delivery trailed slightly with an 8% lift versus last year. For key formats, mass reported stronger spending gains than supermarkets when measuring delivery and pickup orders combined.

Online’s share of weekly grocery spending in November ended the month at 17.1%, climbing 340 bps versus November 2024. The share expansion was fueled largely by higher spending rates in large metro markets, by the 30 to 44 age group and by households earning $100,000 or more annually.

“Today’s grocers face a very competitive environment marked by fundamental changes in shopping behavior,” Bishop says. “The online grocery customer pool continues to expand, order frequency has steadily grown for over a year and spending remains resilient, which shows that e-grocery is evolving from just a convenient option to the preferred way to get groceries for many.”

For more information, visit the e-grocery Monthly Sales report page.