“Chile is a powerhouse in global fruit exports.” So says the USDA's Foreign Agricultural Service.

“Chile is recognized as one of the world's leading fruit exporters, ranking fifth globally with exports exceeding $8.2 billion,” reads a recent FAS report. It goes on to name fresh cherries, blueberries and table grapes among the country's standout products. And the U.S. consumes a good deal of those products.

The U.S. is Chile's second-largest destination after China for all exported goods, according to the World Trade Organization. Fresh fruit and fruit-derived products top its agricultural exports by value. Stone fruit — especially cherries, but also apricots, plums and peaches — occupied the most valuable line item in that category, representing roughly 18% of the value share of its agricultural exports, in 2022.

Chile also represents an important piece of the puzzle that is getting U.S. consumers fresh fruit all year round.

“Chile continues to invest in the U.S. market and is one of the largest suppliers of fresh fruit to the U.S. during the winter months,” says Joe Klick, associate vice president of product management for Naturipe.

Chile's growing climate is ideal for winter fruit, he adds, and its steady investment in fruit quality and logistics has helped make year-round fresh fruit possible.

Of course, Chile isn't the only Central or South American country to target the U.S. market and its love of tropical fruit and demand for fruit all year. Colombia seeks to drive U.S. demand for its avocados, for instance, and Peru recently set a new all-time record for its mango exports to the U.S.

“Peru's growth in both volume and quality has raised the bar across the board,” says Klick, speaking about blueberries. “Chile responded by dialing up its own game. You're seeing more focus on premium fruit and proprietary varieties that deliver standout flavor and consistency. It's all part of staying competitive and keeping those berries at their best.”

Getting fresh fruit from Chile — a trip that can take over 4,800 miles by sea from the closest seaports or 4,100 miles by air from the main airports — can be a challenge, however. Klick says the country is rising to the occasion with the competition sparking innovation.

“We're seeing smarter, faster shipping routes and exciting advancements in genetics that extend shelf life and deliver better flavor,” he adds. “Plus, Chile's timing is great as its fruit lands just as the import season wraps and U.S. crops start up. It keeps the momentum (and the berries) rolling year-round.”

Building Blueberry Demand

Speaking of those blueberries, Klick says Chile has been keeping U.S. consumers stocked in winter for decades.

“Chile actually helped pioneer the winter blueberry market here in the U.S.,” he adds. “They got started back in the late ‘80s and early ‘90s, then really took off between 2004 and 2008.”

The USDA's Economic Research Service calls blueberries the second-most economically important berry behind strawberries. And it's one that has grown in popularity. Compared to 1980, when the per-capita availability (a stand-in for consumption) of fresh blueberries stood at not even a fifth of a pound, in 2023 it was over 2.6 pounds.

That growing demand has to be supplied from somewhere. In 2023, the U.S. imported 558.62 million pounds of fresh blueberries according to USDA. Imports from Chile represented roughly 16% of total U.S. blueberry imports that year.

The U.S. has been the top market for Chilean fresh and frozen blueberries, receiving more than half of the Chilean export volume annually in recent years. Fresh Chilean blueberries are imported into the U.S. from September through April, with volumes peaking in January and February. In the completed 2024-25 market year, the U.S. imported 87.28 million pounds of fresh blueberries (cultivated and wild) from Chile.

Klick says that most of Chile's blueberry fields, which are located in the north-south middle of the coastal country, have Mediterranean climates.

“Cool winters, dry summers, and low disease pressure are basically perfect growing conditions,” he says. “Combine that with Chile's top-tier export systems and cold chain logistics, and you get fresh, flavorful berries.”

He adds that Naturipe sees Chile as a key partner in supplying year-round blueberries and projects good things for Chile's peak blueberry season this year.

“Come January and February, shoppers can expect plenty of top-notch Chilean blueberries ready to enjoy,” Klick says.

Table Grape Competition and Oversupply is a Challenge

Fresh table grapes are another area where Chilean fruit exports to the U.S. shine.

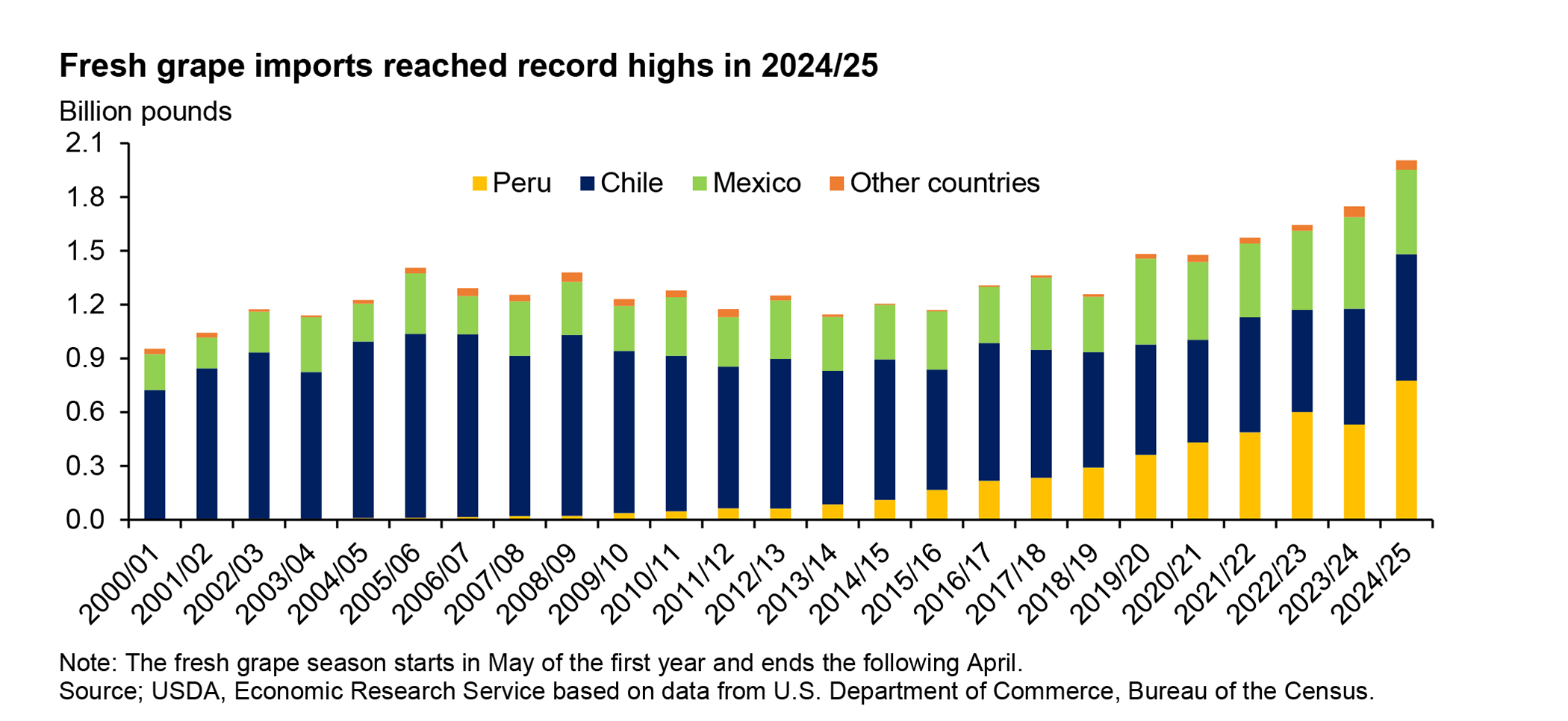

The U.S. is the main export market for the Southern Hemisphere's table grapes. According to ERS, U.S. imports of table grapes from May 2024 through April 2025 exceeded 2 billion pounds. Almost all (97%) of that volume came from Chile, Peru and Mexico.

Chile has historically been the primary source for the U.S.'s imported table grapes by volume, though Peru has become a key source of competition to Chile for U.S. table grape import market share.

“Table grape production in Chile has been faced with tight margins, due in part to export competition from neighboring Peru putting downward pressure on prices,” read the July Fruit and Tree Nuts Outlook by ERS.

Frutas de Chile reports that the country's total global exports are down almost 7% year-over-year, despite increases in the U.S. The reason for this decrease is “The acceleration of the varietal replacement process, where new varieties are gaining ground but have not yet fully replaced older, phased-out varieties,” the group explains. It estimates that new grape varieties are expected to represent 71% of total Chilean table grape exports this season, up from 67% last season.

However, there might be fewer grapes going to the U.S. in the near future.

“Shipments to Latin America are expected to increase by 14%, while shipments to Asia and North America are projected to decrease by 18% and 9%, respectively,” the group says, adding that it “will be running a robust consumer and trade campaign throughout the season.”

Indeed, the recently formed Global Grape Group, of which Frutas de Chile is a member together with Peruvian and Mexican representatives, has the goal to grow U.S. table grape demand to address the current mismatch between supply and demand.

“In the last eight years, we have seen a 40% increase in the supply of Southern Hemisphere grapes to its main market, the U.S., while demand has only increased by 3% during the same period,” said Ignacio Caballero, executive director of Frutas de Chile's Table Grape Committee, at the Second International Table Grape Congress held in August. He added that it is crucial for the entire industry, not just Chile, to increase table grape demand.

Record-Setting Export Volumes Projected for Cherries

Discussion of Chilean fruit exports wouldn't be complete without cherries. The FAS even called cherries “the jewel of Chilean fruits.”

“In the southern hemisphere, Chile accounts for 96% of cherry exports, reinforcing its global leadership in this market,” says Frutas de Chile, adding that the Chilean Cherry Committee projects total exports of to reach 131 million boxes during the 2025-26 season.

The FAS estimates that volume as 670,000 metric tons, or 1.48 billion pounds, a record for the country if realized, assuming no “unexpected shocks to the cherry production and export industry.” However, it also notes that China consumed 90.8% of Chile's 2024-25 fresh cherry exports and expects China's demand to remain strong in the upcoming season.

When it comes to exports of Chilean cherries to the U.S., FAS forecasts the U.S. will import a total of 30,000 metric tons or 66.14 million pounds, largely due to increased shipments from Chile. If realized, this would be a record for U.S. cherry imports.

“Chile continues to increase its investment in North America, and we will see an expanded consumer and retail campaign this season,” reports Frutas de Chile. The group says that the first air shipments of Chilean cherries usually hit New York markets in late October, and it reports that product on those early flights were cited as being of excellent condition.

“Peak U.S. availability [runs] from late December through February, with the first charter vessel arriving on the East Coast in mid-December,” the group adds, noting that it is “working with retailers to promote over the holidays, New Year's, Valentine's Day and National Cherry Month in February.”

Your next reads:

- Tropical Fruit Takes the Spotlight on National Tropical Fruit Day

- Fresh Trends 2025: Driving demand in an age of uncertainty

- Colombian Avocado Board Eyes Exponential Growth in U.S. Market

- National Mango Board's Director Reflects on 20 Years of Industry Growth

- Newly formed Global Grape Group launches campaign to drive demand